BLOG Topics 2023

January 2023 Unions & Southwest Management

February 2023 Can a merger of two airlines actually increase competition

February 2023 Can a merger of two airlines actually increase competition

"To read the Prologues from Danger Zone, Murder at the Front Door, or Murder Outside the Back Door click on one of the above links, for Murder By the Bathhouse Door, scroll Down

Danger Zone by John Tommasi on Amazon

Hi all, one good thing about the quarantine is I finished the great American novel. It is an action- adventure, detective mystery that is loosely based on my tenure working for the state of NH as an undercover operative. The action goes from NH to Florida and Jamaica to the Bolivian jungles; Enjoy! It is also available on paperback. If you click the link above, titled Danger Zone, I've posted the Prologue and Chapter 1.

ps you can download it to a pc or phone with the kindle app from Amazon, it is free for Prime members.

https://www.amazon.com/s?k=danger+zone+tommasi&ref=nb_sb_noss

MURDER AT THE FRONT DOOR on Amazon

The true and bizarre story of the murder of Robert Cushing Sr. by off duty Hampton Police Officer Robert McLaughlin on June 1, 1989 is now available on Kindle and Paperback at Amazon

Murder Outside the Back Door: The true story of the murder of a popular Salem, NH school teacher by her husband. The murder was labeled as a Charles Stuart copycat .

Murder by the Bathhouse Door

The following is the prologue and Chapter 1 from my upcoming book that should be available in early fall. It is about the murder of two Salem NH girls in 1997 by three boys who wanted to see what it was like to kill someone.

|

Hi All, Murder by the Bathhouse Door is now available on Amazon and can be obtained by clicking the link below: https://www.amazon.com/Murder-Bathhouse-Door-murder-teenage-ebook/dp/B0C4BCTHRB/ref=sr_1_1?crid=PTIKOVXSIGDT&keywords=murder+by+the+bathhouse+door&qid=1683466946&sprefix=%2Caps%2C91&sr=8-1 The Prologue and Chapter 1 are available on the page that can be found under More |

Monsters at the Door

Now Available on Amazon

https://www.amazon.com/Monsters-Door-Killers-capture-prosecution-ebook/dp/B0CW1M4QHN/ref=sr_1_1?crid=H95TCD9QGTO2&dib=eyJ2IjoiMSJ9.6tKo-vfO-UMDDrul5-YtN-F4DAe0gPnGH3Qfzn2tqS0.n6UPTTBJIIBWhTYz6cYWmo8lqvD-Ggf_WuGFu72z73U&dib_tag=se&keywords=Monsters+at+the+door+john+tommasi&qid=1711799034&sprefix=monsters+at+the+door+john+tommasi%2Caps%2C110&sr=8-1

Monsters at the Door chronicles the murder and subsequent arrest of three serial killers.

The Prologues of the first two stories are below

Book 1, Murder Inside the Car Door, concerns the killing of Arlene Boland by Francis Vercauteren in 1976 in Salem NH. Arlene was the daughter of then Salem Police Officer Don Boland.

Vercauteren had a long history of serial rapes and jail time. The story looks at the initial crime scene and the cooperation of several police agencies culminating in Vercauteren's arrest and subsequent guilty plea. However the story is far from over since Vercauteren escapes twice from the New Hampshire State Hospital and after the second escape, it chronicles the 10 year manhunt for the fugitive.

Book 2, Murder Inside the Bedroom Door, is about Albert DeSalvo, the alleged Boston Strangler. The story looks at his childhood and early exposure to sex and what it made him. The Book chronicles the 13 murders attributed to the Strangler and dogged investigation by Lt. John Donovan, the head of Boston's homicide unit and DeSalvo's arrest for being a serial rapist, trial, conviction and his subsequent confession to being the Boston Strangler.

Book 3, Murder Inside the Dormitory Door, chronicles the murder of 5 college students by the Gainsville Ripper, Danny Rollings and his desire to be a "superstar" like Ted Bundy. These murders were the basis for the 1996 Movie Scream and the movie Scream was watched incessantly by three boys who enacted out the movie in real life portrayed in my book, Murder by the Bathhouse Door.

The Prologues of the first two stories are below

Book 1, Murder Inside the Car Door, concerns the killing of Arlene Boland by Francis Vercauteren in 1976 in Salem NH. Arlene was the daughter of then Salem Police Officer Don Boland.

Vercauteren had a long history of serial rapes and jail time. The story looks at the initial crime scene and the cooperation of several police agencies culminating in Vercauteren's arrest and subsequent guilty plea. However the story is far from over since Vercauteren escapes twice from the New Hampshire State Hospital and after the second escape, it chronicles the 10 year manhunt for the fugitive.

Book 2, Murder Inside the Bedroom Door, is about Albert DeSalvo, the alleged Boston Strangler. The story looks at his childhood and early exposure to sex and what it made him. The Book chronicles the 13 murders attributed to the Strangler and dogged investigation by Lt. John Donovan, the head of Boston's homicide unit and DeSalvo's arrest for being a serial rapist, trial, conviction and his subsequent confession to being the Boston Strangler.

Book 3, Murder Inside the Dormitory Door, chronicles the murder of 5 college students by the Gainsville Ripper, Danny Rollings and his desire to be a "superstar" like Ted Bundy. These murders were the basis for the 1996 Movie Scream and the movie Scream was watched incessantly by three boys who enacted out the movie in real life portrayed in my book, Murder by the Bathhouse Door.

Prologue

- Monsters at the Door

September, 1976

“I felt that she had gotten me into trouble. If it hadn’t been for her, I wouldn’t have done it. It was her fault for being near her car at two in the morning.”

1946 – 1976

He was named after his father and four years after his birth in 1946, he, his mother and two siblings were abandoned by their thirty-four year old father, Francis L. Vercauteren. His mother couldn’t handle the pressure and didn’t have the adequate finances for bringing up three children. As a result, his mother gave his sister and brother to friends, and Francis, who was called Frank, was sent to an orphanage. During the five years that he was at the orphanage, he suffered both physical and sexual abuse at the hands of the staff and other orphans.

Frank drifted to a number of foster homes, but didn’t stay at any one for long as a result of discipline problems, which included stealing and assaults.

He once told a psychiatrist that, “I just couldn’t seem to stick to the rules.”

At age 12, his mother remarried and Francis Vercauteren moved in with them along with his two siblings. However, within a year, he was sent to a boarding school since he was unable to get along with his stepfather.

One psychologist hypothesized that Vercauteren’s crimes later in life, particularly assaultive behavior towards women, appear to be a result of an intense anger towards women stemming from his lack of a loving relationship with his mother.

Over the years, Vercauteren was interviewed by multiple psychiatrists, usually court ordered. He once said, “My mother didn’t have to abandon me in an orphanage and boarding school. Of her three children, I fared the worst whether she intended it or not. I’ve never forgiven her for that. I think what she did was convenient for her and she didn’t care about me. It’s all her fault that I am what I am.”

At age 18, Vercauteren joined the Air Force and after he finished basic training in Lackland, Texas, he was stationed at Elmendorf Air Base outside of Anchorage, Alaska.

While stationed there, he met the 15 year old daughter of a fellow serviceman and within a month, she was pregnant. His son, James Anthony, was born 10 days after they were married.

In 1968, Vercauteren received an honorable discharge from the Air Force and moved to Washington, D.C. While there he attended a police academy and it is believed he became a county sheriff in Maryland. Some accounts say that he was a New Jersey State Trooper, however, records are incomplete.

Soon after he was employed, he began drinking heavily and his wife and son left him and moved in with her parents.

In September of 1968, Vercauteren was arrested for forcing a woman, while holding a gun to her head, to perform oral sex on him. He was fired from his police job but kept his badge and police identification.

At his trial, he was sentenced to the psychiatric ward at St. Elizabeth Hospital in Washington, D.C. and later transferred to Danvers State Hospital in Danvers, Ma. He was released in late 1969.

In March of 1970, he was again arrested. This time for sexually assaulting a 13 year old girl in Lawrence, Ma.

He pleaded guilty to indecent assault and battery and was placed on probation with the recommendation that he receive psychiatric care. He began to see Boston psychiatrist, Dr. Robert Mezer, but stopped after a few visits claiming that he could no longer afford the visits.

It seemed that these sessions had no effect since he was once again arrested for assaulting a woman, this time in Milford, Ct. According to records, Vercauteren raped and choked her and left her to die. Fortunately, a passing motorist saw her and contacted police and an ambulance.

In a negotiated plea, a charge of assault with intent to kill was dropped, and Vercauteren pled guilty to a charge of rape with the intent to assault. He received a sentence of 5 – 10 years and had to undergo psychiatric evaluation.

Vercauteren told the psychiatrist, “I didn’t look at the woman I choked, I looked up in the air. It wasn’t me doing it, it was someone else. It wasn’t my fault.”

After completing a number of initial consultations with a psychiatrist, Vercauteren was assigned to a therapist who held a bachelor’s degree in sociology. Vercauteren later stated, “She didn’t help me at all. At one time she told me that she didn’t want to be a therapist and didn’t really know what she was doing.”

In March of 1976, Vercauteren was paroled.

********

After he was paroled, he met a woman and moved in with her and her 5 children. He tried to support them for three months, but found it to be too much. Vercauteren later told Dr. Mezer, “I was okay for a couple of months but it just became too much for me. I got confused, I put my fist through the wall and began drinking. I screamed at people and began going downhill.” He eventually left and moved in with his brother, who was a firefighter, and sister-in-law in Methuen Ma.

In June of 1976, Vercauteren’s condition was quickly deteriorating. He had previously said to Dr. Mezer, “I wandered all over following women. I singled out particular women and they were going to be mine. They were going to have sex with me and it only seemed natural. They were going to want to have sex with me, I wouldn’t have to force them. I was intent on killing a girl.”

On Sunday, August 15, 1976, Arlene Boland became that girl.

Murder Inside the Bedroom Door

March 1965

The lawyer was brought into the prison interview room. The prisoner was already seated. After the lawyer sat down, the prisoner spoke.

“Hypothetically, if a man had done some terrible things, and if he were sick and wanted those things known so that he could get better help and maybe do some good to society, could a lawyer help him do that.”

The lawyer pondered a moment, “Yes, but it might be a ticklish business.”

The prisoner was Albert DeSalvo.

The lawyer was F. Lee Bailey.

********

1931 - 1948

Albert Henry DeSalvo was born September 3, 1931, in Chelsea, Massachusetts. He was the 3rd of six children born to Frank and Charlotte DeSalvo. Albert's childhood was marked by violence and cruelty, primarily from his father.

His mother was constantly beat by his father and at one time, DeSalvo describes his father punching his mother on the floor and bending back her fingers and breaking them. When Albert was told to “get lost,” and when he didn’t move fast enough, he was hit in the back with a pipe.

His father would also bring prostitutes home and have sex in front of his kids. At one point, when Albert was 7, his father had one of the prostitutes introduce Albert to his first sexual encounter.

One psychiatrist felt that DeSalvo was socialized to violence, and to Albert, sex and aggression became one and the same. After he admitted to being the Boston Strangler later in life, DeSalvo stated, under hypnosis, that he was trying to help the women he strangled and that “In order to help them, you had to hurt them.”

Age 7 marked the first time DeSalvo was arrested. He and a friend broke into a neighbor’s house and stole a fur coat. They were caught by a neighbor who called the police. He was released to his parents and was beat by his father, not because he stole, but because “he was caught.”

During his childhood, Albert was abusive towards animals, a common trait amongst serial killers. Albert would brag about catching stray dogs and cats, putting them in a cage and watch them fight to the death. He would also shoot arrows into the cage killing them.

At age 9, DeSalvo had a 12 year-old girlfriend who would perform fellatio on him 2 or 3 times per week.

At age 11, he was arrested for beating up and stealing $2.85 from a paperboy, ($66 in 2024 money). He was given probation.

At age 12, Albert was arrested for assault and armed robbery with a fake gun of a local jewelry store. He ran off with $27 worth of jewelry; ($630 in 2023). He was sentenced to the Lyman School for boys.

When asked why he was stealing, he said, “only sissies didn’t steal in his neighborhood and he wanted the money to spend.”

The Lyman School was established in 1848 and was in operation until 1971. It was the state’s first reform school and was located in Westborough, Massachusetts. Students lived in “cottages” of about 100 boys each and subject to strict discipline which included corporal punishment.

He was paroled in 1944 and moved in with his mother and her new husband. DeSalvo’s behavior reportedly improved for a couple of years and he worked as a delivery boy making $2 per day ($45 2023).

At age 15 in 1946, DeSalvo was arrested for the theft of a motor vehicle and sent back to the Lyman School until he graduated in 1948 and entered the service as a private in the army at age 17. He was stationed overseas in Germany.

********

US Army, 1948-1955

While in the army, DeSalvo was described as a model soldier who was good looking, affable and charming. He was known as a ladies man and being excessively neat. DeSalvo was popular within the platoon and became the European middleweight boxing champ with a devastating left hook. He reportedly responded well to discipline.

After his first tour of duty, he was honorably discharged but soon re-enlisted. He served in Germany as a Military Police Sergeant with the 2nd Squadron, 14th Armored Cavalry Regiment.

During his two tours of duty, DeSalvo had a highly elevated libido and, by his own account, reportedly had relations with over 1000 women during his two tours.

While in Germany, DeSalvo was particularly enamored by one girl, Irmgard Beck, who he married in December of 1953 after he was honorably discharged from the army. The couple moved to America where they lived modestly despite having a child with a physical disability.

Irmgard was aware that her husband had a voracious sex drive but held off on sex for fear of having another child with a disability. When asked, DeSalvo said that his wife used sex as a weapon, having it with him only when she wanted something.

It was then that Albert DeSalvo worked on a scheme to start seducing women.

The lawyer was brought into the prison interview room. The prisoner was already seated. After the lawyer sat down, the prisoner spoke.

“Hypothetically, if a man had done some terrible things, and if he were sick and wanted those things known so that he could get better help and maybe do some good to society, could a lawyer help him do that.”

The lawyer pondered a moment, “Yes, but it might be a ticklish business.”

The prisoner was Albert DeSalvo.

The lawyer was F. Lee Bailey.

********

1931 - 1948

Albert Henry DeSalvo was born September 3, 1931, in Chelsea, Massachusetts. He was the 3rd of six children born to Frank and Charlotte DeSalvo. Albert's childhood was marked by violence and cruelty, primarily from his father.

His mother was constantly beat by his father and at one time, DeSalvo describes his father punching his mother on the floor and bending back her fingers and breaking them. When Albert was told to “get lost,” and when he didn’t move fast enough, he was hit in the back with a pipe.

His father would also bring prostitutes home and have sex in front of his kids. At one point, when Albert was 7, his father had one of the prostitutes introduce Albert to his first sexual encounter.

One psychiatrist felt that DeSalvo was socialized to violence, and to Albert, sex and aggression became one and the same. After he admitted to being the Boston Strangler later in life, DeSalvo stated, under hypnosis, that he was trying to help the women he strangled and that “In order to help them, you had to hurt them.”

Age 7 marked the first time DeSalvo was arrested. He and a friend broke into a neighbor’s house and stole a fur coat. They were caught by a neighbor who called the police. He was released to his parents and was beat by his father, not because he stole, but because “he was caught.”

During his childhood, Albert was abusive towards animals, a common trait amongst serial killers. Albert would brag about catching stray dogs and cats, putting them in a cage and watch them fight to the death. He would also shoot arrows into the cage killing them.

At age 9, DeSalvo had a 12 year-old girlfriend who would perform fellatio on him 2 or 3 times per week.

At age 11, he was arrested for beating up and stealing $2.85 from a paperboy, ($66 in 2024 money). He was given probation.

At age 12, Albert was arrested for assault and armed robbery with a fake gun of a local jewelry store. He ran off with $27 worth of jewelry; ($630 in 2023). He was sentenced to the Lyman School for boys.

When asked why he was stealing, he said, “only sissies didn’t steal in his neighborhood and he wanted the money to spend.”

The Lyman School was established in 1848 and was in operation until 1971. It was the state’s first reform school and was located in Westborough, Massachusetts. Students lived in “cottages” of about 100 boys each and subject to strict discipline which included corporal punishment.

He was paroled in 1944 and moved in with his mother and her new husband. DeSalvo’s behavior reportedly improved for a couple of years and he worked as a delivery boy making $2 per day ($45 2023).

At age 15 in 1946, DeSalvo was arrested for the theft of a motor vehicle and sent back to the Lyman School until he graduated in 1948 and entered the service as a private in the army at age 17. He was stationed overseas in Germany.

********

US Army, 1948-1955

While in the army, DeSalvo was described as a model soldier who was good looking, affable and charming. He was known as a ladies man and being excessively neat. DeSalvo was popular within the platoon and became the European middleweight boxing champ with a devastating left hook. He reportedly responded well to discipline.

After his first tour of duty, he was honorably discharged but soon re-enlisted. He served in Germany as a Military Police Sergeant with the 2nd Squadron, 14th Armored Cavalry Regiment.

During his two tours of duty, DeSalvo had a highly elevated libido and, by his own account, reportedly had relations with over 1000 women during his two tours.

While in Germany, DeSalvo was particularly enamored by one girl, Irmgard Beck, who he married in December of 1953 after he was honorably discharged from the army. The couple moved to America where they lived modestly despite having a child with a physical disability.

Irmgard was aware that her husband had a voracious sex drive but held off on sex for fear of having another child with a disability. When asked, DeSalvo said that his wife used sex as a weapon, having it with him only when she wanted something.

It was then that Albert DeSalvo worked on a scheme to start seducing women.

Blog Topics 2020

January An Impeachment Primer

February The Coronavirus and the Market.

March/April Balanced Budget and Term limits

May The Cost of the Quarantine and Recovery

February The Coronavirus and the Market.

March/April Balanced Budget and Term limits

May The Cost of the Quarantine and Recovery

Blog Topics 2019

March The Burgeoning US Debt

May China, Trade and Tariffs

June Income taxes: Obama v Trump

July/Aug The China Threat

Sept/Oct The High Cost of College

Blog Topics 2018

January What Kills Bull Markets

May Are Cheap Oil Prices here to Stay

July California and Mandatory Solar Panels

August Tariffs and Trade

September Is a Recession coming?

November Increasing Healthcare Costs

December The Oracle of Omaha

Blog Topics 2017

January Trumponomics Part 2

February The Keystone Pipeline Revisited

March Border Adjustment Tax

April Are Liberal Prof's.....

May Moral Hazard Through a Libertarian's Lens (guest blog from a student)

July What's causing the Opioid Crisis

September The minimum Wage re-visited

November Everything You Want to Know about 401K

December How The New Tax Bill Affects you (spoiler alert: the middle class makes out great)

blog topics for 2013 - 2016 are at page bottom

Minimum Wage Commentary

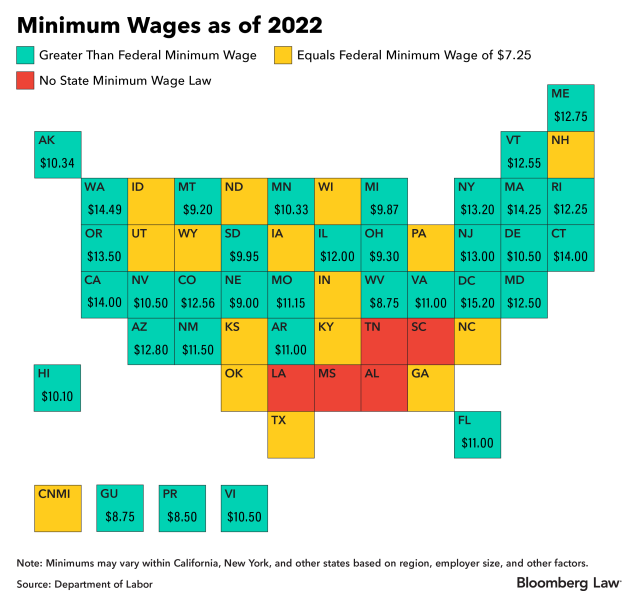

In the new Covid Relief Bill there is a provision for a required $15 minimum wage nation wide. Minimum wage should be left to the individual states. A Federally mandated minimum wage for all states is stupidity personified given the following:

The attached map shows cost of living by state for a market basket of goods that on the average, nationwide, cost $100. The interpretation is a follows: That market basket of goods would cost $139.10 in New York, and $151.70 in Calif. As you can see, the cost of living is 51,7% higher in Calif, the most expensive state, than the national average; however In Mississippi, it would only cost $86.10. If you do the math, the cost of living is 76.2% high in California than Mississippi Even if you compare Calif and NH, the cost of living in Calif is 38.2% higher than NH

As a result, I feel that a one-size-fits-all federally mandated minimum wage is ludicrous and it should be left up to the individual states.

The attached map shows cost of living by state for a market basket of goods that on the average, nationwide, cost $100. The interpretation is a follows: That market basket of goods would cost $139.10 in New York, and $151.70 in Calif. As you can see, the cost of living is 51,7% higher in Calif, the most expensive state, than the national average; however In Mississippi, it would only cost $86.10. If you do the math, the cost of living is 76.2% high in California than Mississippi Even if you compare Calif and NH, the cost of living in Calif is 38.2% higher than NH

As a result, I feel that a one-size-fits-all federally mandated minimum wage is ludicrous and it should be left up to the individual states.

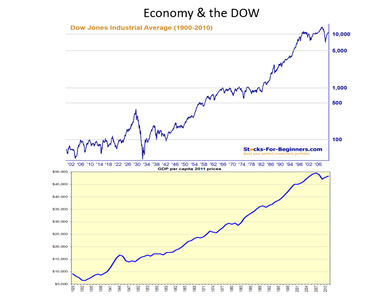

Economy and the Dow

Click to Enlarge

Click to Enlarge

As you can see from the attached charts, the stock market mirrors the American Economy, and granted, there are bumps in the road but both ALWAYS recover. Stop checking your retirement accounts and do nothing. You, and believe or not, even me (yes I am making fun of myself), cannot time the market, but it will recover.

Today the Dow dropped 10%, 2352 points, which is the worst point drop ever and the largest point drop since Black Monday in 1987 where it dropped over 23%; and this drop occurred in spite of the FED announcing that it would inject up to $1 trillion into the economy. Once again, there are no rational expectations in the market, just hysteria and the hysteria will eventually diminish.

The wealth effect is an increase in consumption (and accompanying decrease in savings) as a result of an individuals assets (usually a portfolio or land/home) increasing in value. A negative wealth effect is just the opposite, and since most indexes declined more than 10% and tested bear market territory, this appears to be the case. Conversely, the market recovered in January and all losses and more were covered.

FICO SCORES

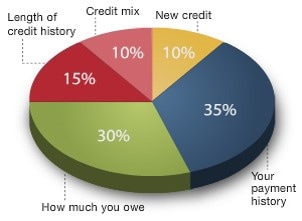

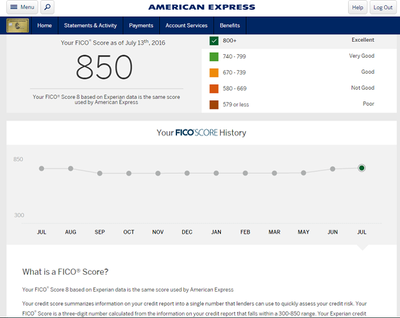

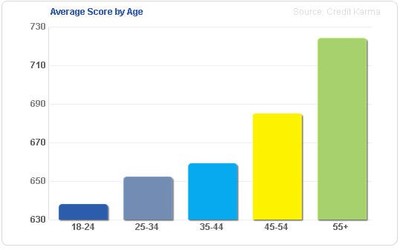

Fair Isaac Company reports that it's FICO scores (FICO being an acronym for Fair Isaac Co) reports that the average FICO score in the US has reached an all time high of 700 nationwide amongst adults. The share of consumers who are viewed as the riskiest from a credit perspective (these are sub-prime and have a score lower than 640) reached a new low of about 40 million — or 20 percent of adults in the U.S. that have FICO scores. according to the Wall St Journal. A lot of you may be asking what is a FICO score, how is it calculated and how it affects me. Fair Isaac uses use information provided by one of the three major credit reporting agencies – Equifax, Experian or Trans-Union. From this, they have a formula to get a credit score which can be as high as 850. The biggest part is your payment history, followed by how much you owe, credit history, credit mix and new credit (see chart). Next, how do you interpret your FICO Score: anything > 800 is excellent (and gets you low interest rates on loans and credit cards), 740-799 is very good, 670-739 is good, and anything less than 670 is considered not good and sub-prime (chart). Lastly, as no surprise, the older you are, the better your score (chart)

Fair Isaac Company reports that it's FICO scores (FICO being an acronym for Fair Isaac Co) reports that the average FICO score in the US has reached an all time high of 700 nationwide amongst adults. The share of consumers who are viewed as the riskiest from a credit perspective (these are sub-prime and have a score lower than 640) reached a new low of about 40 million — or 20 percent of adults in the U.S. that have FICO scores. according to the Wall St Journal. A lot of you may be asking what is a FICO score, how is it calculated and how it affects me. Fair Isaac uses use information provided by one of the three major credit reporting agencies – Equifax, Experian or Trans-Union. From this, they have a formula to get a credit score which can be as high as 850. The biggest part is your payment history, followed by how much you owe, credit history, credit mix and new credit (see chart). Next, how do you interpret your FICO Score: anything > 800 is excellent (and gets you low interest rates on loans and credit cards), 740-799 is very good, 670-739 is good, and anything less than 670 is considered not good and sub-prime (chart). Lastly, as no surprise, the older you are, the better your score (chart)

Strangulation by Regulation:

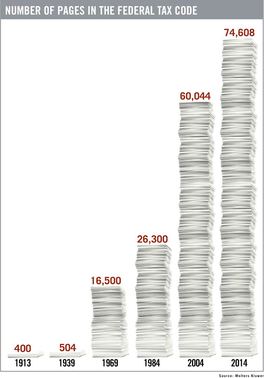

The tax code is 77,000 pages, under Obama there were 4000 new EPA regulations (info from CBS) Dodd-Frank imposed somewhere between 310-500 new requirements on banks(various analysts CNBC) and Obamacare has over 20,000 pages of regulations (Washington Post); and people are complaining because Trump is trying to streamline government. He has signed the "2 for 1" executive order that mandates all agencies to do away with 2 regulations for every one they pass. I can run my life and spend my money, much better than the government and I applaud Trump's efforts in doing away with economically ruinous legislation.

UNH Study Results 5-31-2016

In other News:

First, a little history. In 1800, 90% of the adult population were farmers (lots of factory child labor), by 1900, 25% of the population and currently, about 2% as a result of technology garnering greater yield/acre. As a result much farmland from the 19th century is no longer. In a recent study out of UNH, it was found that 75% of the farmland from the mid 19th century is now covered by trees and this is contributing to warmer winters. Trees causing higher temperatures you say; how is this possible? It is very simple physics. In the winter in NH (and most other states), farm pastures are covered with snow, and this reflects sunlight, and heat, into space. Now that 75% of these pastures are covered with trees, the dark trees absorb the heat and it permeates into the atmosphere causing a general warming and milder winters. If you've ever wondered what a stone wall was doing in the middle of the woods, those woods were once pastures and delineated borders that contained live stock.

Just as a reminder from my blog of October 2013, Carbon dioxide composes only .0387% of our atmosphere (in decimal form that’s .000387), and of all the CO2 currently being produced on the earth, man only accounts for 3.4% (.034 in decimals). Therefore, if you want to calculate the amount of CO2 in the atmosphere caused by man, you would multiply .034 x .000387 to get .0000131 or .00131%.

The Arctic ocean is warming up, icebergs are growing scarcer and in some places the seals are finding the water too hot, according to a report to the Commerce Department yesterday from Consulafft, at Bergen, Norway.

Reports from fishermen, seal hunters and explorers all point to a radical change in climate conditions and hitherto unheard-of temperatures in the Arctic zone. Exploration expeditions report that scarcely any ice has been met as far north as 81 degrees 29 minutes. Soundings to a depth of 3,100 meters showed the gulf stream still very warm. Great masses of ice have been replaced by moraines of earth and stones, the report continued, while at many points well known glaciers have entirely disappeared.

Very few seals and no white fish are found in the eastern Arctic, while vast shoals of herring and smelts which have never before ventured so far north, are being encountered in the old seal fishing grounds.

I apologize, I neglected to mention that this report was from November 2, 1922. As reported by the AP and published in The Washington Post — 96 years ago!

The text in the above example is a genuine transcription of a 1922 newspaper article, an Associated Press account which appeared on page 2 of the Washington Post on 2 November of that year

The Arctic ocean is warming up, icebergs are growing scarcer and in some places the seals are finding the water too hot, according to a report to the Commerce Department yesterday from Consulafft, at Bergen, Norway.

Reports from fishermen, seal hunters and explorers all point to a radical change in climate conditions and hitherto unheard-of temperatures in the Arctic zone. Exploration expeditions report that scarcely any ice has been met as far north as 81 degrees 29 minutes. Soundings to a depth of 3,100 meters showed the gulf stream still very warm. Great masses of ice have been replaced by moraines of earth and stones, the report continued, while at many points well known glaciers have entirely disappeared.

Very few seals and no white fish are found in the eastern Arctic, while vast shoals of herring and smelts which have never before ventured so far north, are being encountered in the old seal fishing grounds.

I apologize, I neglected to mention that this report was from November 2, 1922. As reported by the AP and published in The Washington Post — 96 years ago!

The text in the above example is a genuine transcription of a 1922 newspaper article, an Associated Press account which appeared on page 2 of the Washington Post on 2 November of that year

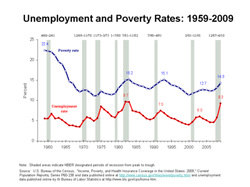

Commentary on Minimum Wage

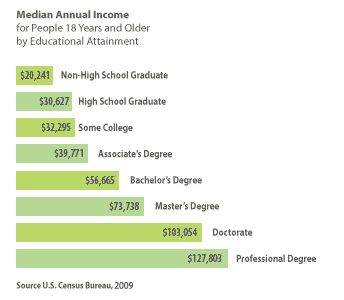

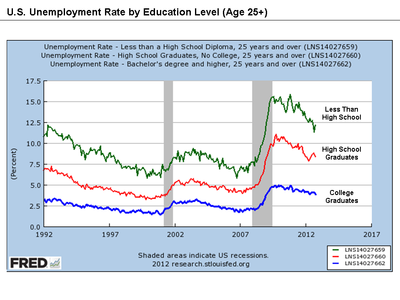

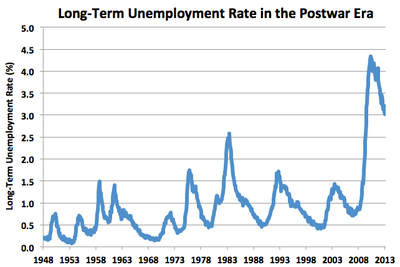

The main argument concerning minimum wage is that it will help to alleviate poverty. That is clearly not the case. As you can see from the chart at the left, the poverty rate dropped dramatically in the 1960's. This was a function of great society legislation; specifically, increase in Social Security benefits in addition to the inception and implementation of Medicare and Medicaid. Since then, the poverty rate has fluctuated between 9-15% and is highly correlated with the unemployment rate. The vertical grey area's in the graph represent periods of recessions in the US. As can be expected, unemployment rises during recessions and peaks at the end (unemployment is said to be a lagging indicator). As you can also see from the chart, so too does the poverty rate. There is no indication whatsoever that the poverty rate is affected by increases in the minimum wage. Generally, this is quite the contrary. As can be evidenced from the below left chart, increases in minimum wage can contribute to unemployment and as we can infer from the above chart, as unemployment increases so to does poverty. If you look at NH, they have the lowest state poverty rate in the nation and it generally parallels the national unemployment rate. By raising the minimum wage, you increase business costs. As a result; businesses either pass these costs onto the consumer (in which case inflation nullifies any wage increase), substitute capital for labor, or simply go out of business. If you look at the chart below right, UAW (United Auto Workers) membership has decreased in the late 1970's from 1.5 million to 350,000 in 2009. The reason for this is simple. Detroit isn't making fewer cars, they are making more, but they have made their assembly lines more robotic and have substituted capital for labor, which became cheaper in the long run. This can also happen to those fast food workers who want a $15 minimum wage. There is currently a machine on the market that can make 300 burgers/hour. In other words, capital can be substituted for labor. Someone please e-mail me and explain how someone is better off unemployed at $10-15/hour as opposed to being gainfully employed at $7.25/hour

You cannot legislate equality. If you want to decrease poverty, implement policies to insure that higher levels of education is available to all.

You cannot legislate equality. If you want to decrease poverty, implement policies to insure that higher levels of education is available to all.

BLOG Topics 2013

January Do Protected Seals lead to Depleted Fish Stocks

February Prohibition: Profits to Cartels & Increased Violence for Americans

March Increased Minimum Wage & Extended benefits lead to Higher Unemployment

April Ethanol from corn & Agflation

May Cash for Clunkers lead to Higher Used Car Prices & Wasted Tax Dollars

June The Affordable Care Act; Anything but Affordable Part 1

July The Affordable Care Act; The poster Child for False Advertising

August Detroit: Higher Taxes + Liberal Benefits = Bankruptcy

September No Keystone Pipeline leads to more pollution

October Global Warming! Or is it Global Cooling!

November Poverty & Benefits

December Does Affirmative Action lead to Reverse Discrimination?

February Prohibition: Profits to Cartels & Increased Violence for Americans

March Increased Minimum Wage & Extended benefits lead to Higher Unemployment

April Ethanol from corn & Agflation

May Cash for Clunkers lead to Higher Used Car Prices & Wasted Tax Dollars

June The Affordable Care Act; Anything but Affordable Part 1

July The Affordable Care Act; The poster Child for False Advertising

August Detroit: Higher Taxes + Liberal Benefits = Bankruptcy

September No Keystone Pipeline leads to more pollution

October Global Warming! Or is it Global Cooling!

November Poverty & Benefits

December Does Affirmative Action lead to Reverse Discrimination?

Blog Topics 2014

January Will Lake Meade become another Aral Sea

February Does Taxing the rich hurt the economy

March The Cause of the Great Depression

April Temporary Agricultural Subsidies lead to wealthy Farmers and Higher Prices

May The Presidents Stance on Gun Control leads to Increased Gun Ownership

June Is there really a Gender Pay Gap

July Did the Supreme Court decision in Roe v. Wade lower the crime rate

August Department of Education and wasted Money

October The Financial Follies of the EPA

November Social Security and Portfolio Diversification

December The White House and Terrorism

February Does Taxing the rich hurt the economy

March The Cause of the Great Depression

April Temporary Agricultural Subsidies lead to wealthy Farmers and Higher Prices

May The Presidents Stance on Gun Control leads to Increased Gun Ownership

June Is there really a Gender Pay Gap

July Did the Supreme Court decision in Roe v. Wade lower the crime rate

August Department of Education and wasted Money

October The Financial Follies of the EPA

November Social Security and Portfolio Diversification

December The White House and Terrorism

Blog Topics 2015

January Does Implementation of the Death Penalty lead to higher costs

February Less Competition and Higher Hospital Costs

March Millionaires Who Get Subsidies from the Affordable Care Act

April The Unintended Obama Legacy

May The NY Times and $15 Minimum Wage

June Are Disability Payments Bankrupting Social Security

August Seattle's $15 minimum wage and it's Surprising Consequence

October The Great Stagnation: The Obama Legacy

November Poverty in the United States

December Should Insider Trading be Legalized: Part one by Olivia Marchioni

February Less Competition and Higher Hospital Costs

March Millionaires Who Get Subsidies from the Affordable Care Act

April The Unintended Obama Legacy

May The NY Times and $15 Minimum Wage

June Are Disability Payments Bankrupting Social Security

August Seattle's $15 minimum wage and it's Surprising Consequence

October The Great Stagnation: The Obama Legacy

November Poverty in the United States

December Should Insider Trading be Legalized: Part one by Olivia Marchioni

Blog Topics 2016

January Should Insider Trading be Legalized: Part 2

February The Presidential Election & the Economy

March Does Narcan Increase Heroin Use

April Is NOAA destroying the American Fisherman

June Will California Style Power Outages Happen in New England

July Textbooks, Inflation & the FTC

Sept Economic strangulation by Regulation

Oct Is this the Best we have?

Nov The High Cost of Prescription Drugs

Dec Trump, the Economy & Animal Spirits

February The Presidential Election & the Economy

March Does Narcan Increase Heroin Use

April Is NOAA destroying the American Fisherman

June Will California Style Power Outages Happen in New England

July Textbooks, Inflation & the FTC

Sept Economic strangulation by Regulation

Oct Is this the Best we have?

Nov The High Cost of Prescription Drugs

Dec Trump, the Economy & Animal Spirits

iOMe Challenge 2012

The United States has amongst the lowest savings rate for all technological nations. The iOMe challenge is a nationwide competition between Colleges where teams submit a 10,000 page essay on how Americans can improve their savings rates. In addition, teams must produce an approximate 60 second video which complements the essay. If you click on the iOMe logo above, it will take you to Bentley University's 2012 video submission. The faculty adviser for the challenge is John Tommasi and is offered during his Fall EC 351 course, Contemporary Issues in Economics.

I'm pleased to announce that on February 15, Bentley was declared the winner of the iOMe video portion of the contest. Congrats to the team members and great job! |

EC 3900 Energy Economics

EC 3900, Energy Economics and International Markets, is a 3 credit, Short Term Program, that is offered during Spring semester. After 7 weeks of lecture, the class takes a 10 day educational/cultural tour to France where 80% of their electricity is produced by nuclear power. During the 10 day trip, students travel to, and tour various nuclear facilities Last year's class visited; Marsailles, Aix en Provance, Lyons, Brest and 4 days in Paris.

|

Unintended Consequences

If there were ever words that can strike fear into the hearts of any man women or child, it's: "I'm from the Government and I'm here to help". On a monthly basis my blog, from an economic standpoint, will explore government laws, decisions and actions, which while well intentioned, had inadvertent results that were either disastrous, or made a bad situation worse. It wouldn't surprise me if you reached the conclusion that congress does two things well, nothing and overreact; and you may ask yourself, do Congressional members vote for what is best for the economy, or what will get them re-elected.

iOMe Challenge 2012 - Video |

iOMe Challenge 2011 - Video |