DISCLAIMER:

Please Note: These stock picks/advice represent my own research and personal opinions and are in no way related to any institution where I have been employed.

Investment involves risk and you invest at your OWN risk. As much as this pains me to say, there are occasions when I am/will be wrong. Your investment decisions are yours alone and you need to do your own due diligence.

Investment involves risk and you invest at your OWN risk. As much as this pains me to say, there are occasions when I am/will be wrong. Your investment decisions are yours alone and you need to do your own due diligence.

How The Dow is Calculated

To calculate the DJIA, the sum of the prices of all 30 stocks is divided by a divisor, the Dow Divisor. The divisor is adjusted in case of stock splits, spinoffs or similar structural changes, to ensure that such events do not in themselves alter the numerical value of the DJIA. The current divisor is .1497. In other words add and subtract the movement of the Dow 30 and multiply by 6.68.

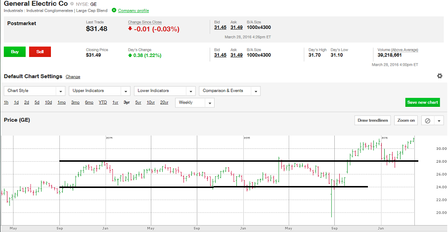

The averages are named after Charles Dow and his business associates, statistician Edward Jones and Charles Bergstresser.. It is an index that shows how 30 large publicly owned companies based in the United States have traded during a standard trading session in the stock market. It is the second oldest U.S. market index after the Dow Jones Transportation Average, which was also created by Dow in 1884. GE is the only stock that has been on the Dow since it's inception in 1896.

You may be wondering why it's not called the Dow Jones Bergstresser average. They didn't like the way Dow Jones & Bergstresser sounded, so they shortened it to Dow Jones & Co., and as a result, poor Charlie Bergstresser lost out on everlasting fame.

The averages are named after Charles Dow and his business associates, statistician Edward Jones and Charles Bergstresser.. It is an index that shows how 30 large publicly owned companies based in the United States have traded during a standard trading session in the stock market. It is the second oldest U.S. market index after the Dow Jones Transportation Average, which was also created by Dow in 1884. GE is the only stock that has been on the Dow since it's inception in 1896.

You may be wondering why it's not called the Dow Jones Bergstresser average. They didn't like the way Dow Jones & Bergstresser sounded, so they shortened it to Dow Jones & Co., and as a result, poor Charlie Bergstresser lost out on everlasting fame.

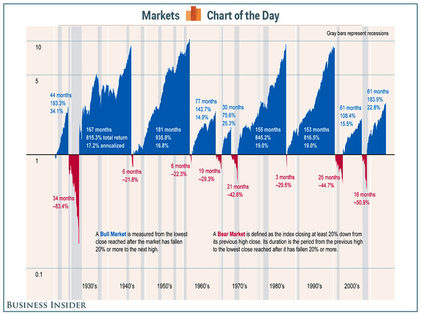

Bear Markets

a downturn of 20% or more, lasting at least 60 days, in any broad equity index such as the Dow Jones Industrial Average, the S&P 500, or the Nasdaq

Stock Pick/Advice 3-7-2021

I am skeptical of any upward movement of the stock market because of a current administration and congress that is anything but business friendly. I have bought General Mill, Verizon and Unitil, all defensive stocks with high dividends.

Stock Pick/Advice 2-6-2021

A few people have asked what my investment strategy is for the Biden Administration. I'm minimizing or staying away from the following sectors: Energy, Financials and Health Care. I like Alternative energy, my best has been the ETF, ICLN, and I like Consumer staples and entertainment like DIS. Utilities are a defensive play and generally pay a good dividend, I like UTL. I'm cautious of tech.

Stock Pick/Advice 6-8-2020

It is rated as a strong buy from MarketWatch This weeks pick is Acadia Pharmaceuticals. From Ameritrade; The Company is focused on the development and commercialization of medicines for central nervous system (CNS) disorders. Its lead drug candidate, NUPLAZID (pimavanserin), is used for the treatment of hallucinations and delusions associated with Parkinson's disease psychosis (PD Psychosis). NUPLAZID is a selective serotonin inverse agonist (SSIA), preferentially targeting 5-HT2A receptors. From Jim Jubak (former VP of CNBC and stock analyst); Acadia is focused on drugs to address central nervous system disorders. It’s first drug, Nuplazid is on the market and recorded $90 million in sales in the first quarter. In the May 7 conference call on first quarter earnings the company forecast a 28% yer over year growth in Nuplazid sales. The company lowered its full year sales forecast to $420 million to $450 million from the prior $440 million to $470 million range as the coronavirus pandemic has led to a decrease in visits to physicians.

But as with all development stage biotech companies what’s important to investors in Acadia is what’s coming (potentially) down the pipeline.

First off, there’s the company’s submission to the U.S. Food & Drug Administration that would expand the approval for Nuplazid to all dementia-related psychosis. That market for DRP is about 10 times that of Nuplazid’s current label. The company will submit Nuplazid for approval across multiple dementia subtypes this summer with a potential approval and launch by the and of 2020. The FDA has granted Nuplazid Priority Review status so that schedule is certainly possible. Th company is also working to have Nuplazid included in the guidelines of the Movement Disorders Society. Nuplazid would be the first FDA-approved treatment for dementia-related psychosis.

Full disclosure: I own this stock and see a short term price target of $53 and long term possibly 60-70.

Stock Picks/Advice 4-19-2020

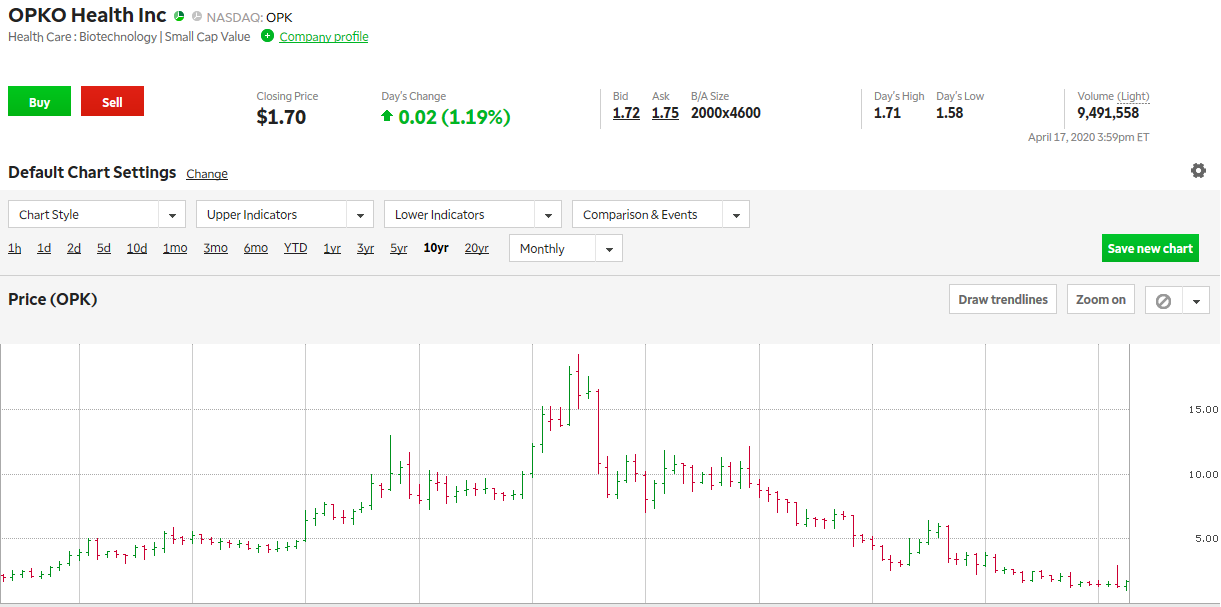

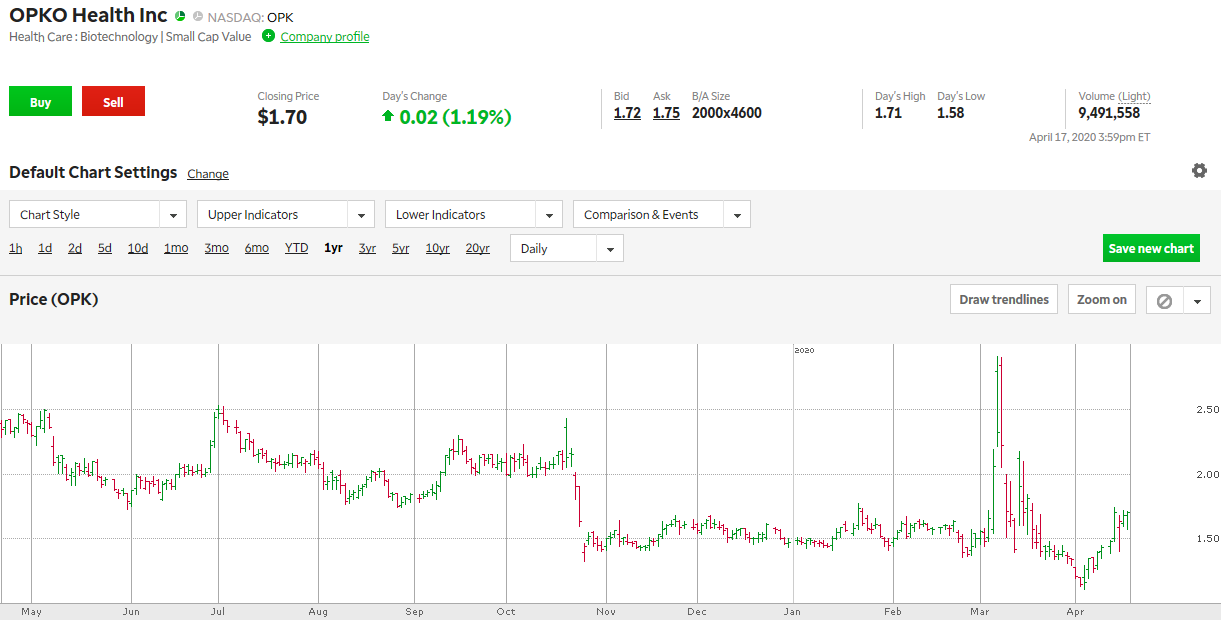

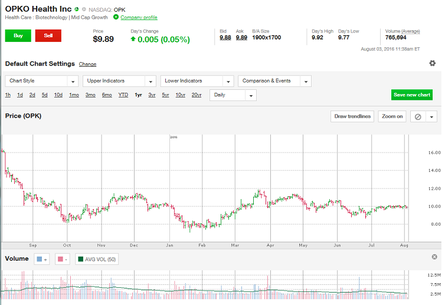

OPKO health, ticker OPK, is a stock that I have followed closely for 7 years. I made a lot of money on it when it went up to $19 and with the shares I own now, I'm currently on the downside. OPKO Health, Inc. is a healthcare company. Its segments include Pharmaceutical, Diagnostics and Corporate. Pharmaceutical consists of the pharmaceutical operations in Chile, Mexico, Ireland, Israel and Spain and its pharmaceutical research and development operations. Diagnostics consists of the clinical laboratory operations in Bio-Reference Laboratories (Bio-Reference) and its point-of-care operations. Through Bio-Reference, it operates laboratory divisions, such as Bio-Reference, GenPath (Oncology), GenPath (Women's Health), GeneDx and Laboratorio Bueno Salud. This stock is RISKY, however, I believe (and many disagree with me) that this this is a $10-$20 stock. It started it's downtrend after it bought BioReference labs in 2015 (10 year chart) which was, a for a time thereafter, poorly run. It's number 1 drug Rayaldee is doing well, but not quite as well as expected, however it continues to see double digit gains in sales every quarter. This stock is out of favor with investors. However, if you look at the 1 year chart, there was a recent spike up to $3 before a 50% pull back, and subsequent upward trend. The reason for this is OPK through BioReference labs is providing Covid 19 test kits with a 24 hour turnaround. OPK is doing between 20,000 to 35,000 tests/day according to a recent statement. As a result, I feel that Revenues and earnings for this quarter will be significantly higher than the previous guidance (given in December) of $168-$173 million. Earnings for the 1st quarter should be announced by mid May. Until then, I'm holding onto my shares.

Stock Picks/Advice 4-5-2020

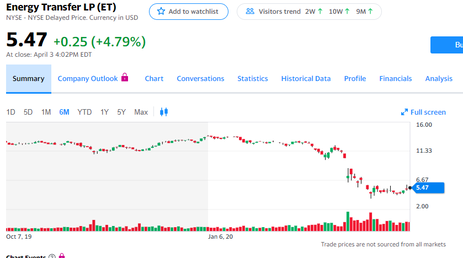

Do not try to time the market, and there are great deals out there, that may go down, but will eventually recover to pre-covid 19 hysteria. I still like all my previous picks and will now recommend ET, Energy Transfer LP. a Master Limited Partnership that pays most of its profits in dividends. Given its current price of $5'47, down from $15, it's dividend is 22%, however I see that dividend $1.22/share, going down in the near future. However, given the price of oil has rebounded 40% from its low last week, it is recovering. If you don't buy this next week, keep an eye on it

Stock Picks/Advice 3-29-2020

I'm surprised I didn't think of this sooner. As I was looking out my window the other day, the lack of traffic was significantly absent; if there is a lack of traffic, there's a lack of traffic accidents and car insurance companies will do exceptionally well. Here are my favorite picks in that industry and I will probably buy Allstate: Allstate, Travelers, CNA Financial, and Chub Ltd. All pay dividends ranging from 2.41% to 4.54%

Stock Picks/Advice 3-22-2020

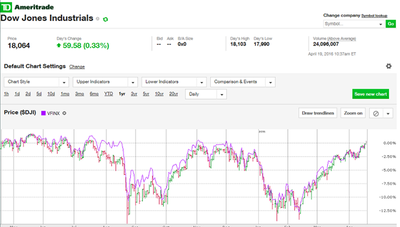

Most analysts will agree that it is impossible to pick tops in the stock market, but sometimes, based on technical analysis you can pick bottoms. From the above chart, the Dow had some weak support at 20,000, where it fluctuated for several days, but after breaking through that support yesterday, it's next support is 17,500 where it is more significant, and I believe that it will hold there as more and more investors will realize that the market is hugely oversold as a result of fear/panic/hysteria selling and start to snatch up stocks. As a result I like the following stocks at the following prices, and all these stocks pay good dividends:

Disney at 60 1.85% dividend

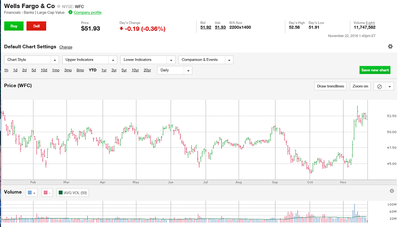

Wells Fargo 23 7.2%

Pfizer at 28 5%

Apple at 200-220 1.3%

Amazon at 1800 0%

Wal Mart now at 114 1.9%

Boeing at 90 I suspect the dividend will go to 0% after it receives a bailout from the government

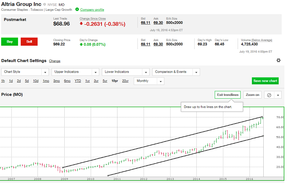

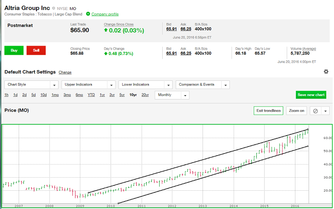

Altria at 30 9.06%

Dunkin Donuts at 30 3.7%

Disney at 60 1.85% dividend

Wells Fargo 23 7.2%

Pfizer at 28 5%

Apple at 200-220 1.3%

Amazon at 1800 0%

Wal Mart now at 114 1.9%

Boeing at 90 I suspect the dividend will go to 0% after it receives a bailout from the government

Altria at 30 9.06%

Dunkin Donuts at 30 3.7%

Stock Pick/Advice 3-15-2020

Stay calm, wash your hands and don't try to time the market. As a result of the recent coronavirus hysteria, the market has had, at one time a more than 20% plunge in less than a month, a record time for entering a bear market, but is it considered a bear market if it is for only one day since the market regained 10% on Friday? Regardless, there are deals out there, especially on stocks that pay dividends. I will mention stocks that I like, and I will leave it up to you when to buy. However, if you buy and they god down, RELAX, the market ALWAYS recovers, particularly if you have strong stocks. I have already bought Apple and Royal Dutch Shell (RDS.A current has over a 10% dividend), I also like and will probably buy somewhere down the road: JP Morgan or Bank of America, Altria, National Health Investor and if you're looking for a risky stock OPKO health that just received a contract with the state of NY to supply the state with 5000 test kits/day. I own OPK (ticker), but keep in mind it is risky. There are more expensive stocks that are also buys such as Alphabet (parent company of Google, Amazon, and Microsoft. I am staying away from airlines and cruise ships, they have been hit hard (30-50%) and have high debt/equity ratios.

Stock Pick Advice 2-1-2020

Royal Dutch Shell, RDS.A, is a screaming buy. It has had 14 down days in a row and is currently selling at $55.74/share. It has been beaten down, along with other oil stocks, as a result of falling oil prices, in part, because of the coronavirus. But this company stands out amongst the rest and is a VALUE buy. It's PE ratio is 11.21 against the industry average of 16, it has a Zack's buy rating of 2, overweight and a PEG ratio of 2.11. The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period.

The PEG ratio is used to determine a stock's value while also factoring in the company's expected earnings growth and is thought to provide a more complete picture than the P/E ratio. A very attractive feature is it's dividend yield is 6.72% and is at the bottom range of a 5 month trading channel (chart).

In pre-market trading on Thursday 1-30-2020, it is down to $53, if you look at a 10 year chart, there is significant support at $50 and that would be my recommended buy point.

The PEG ratio is used to determine a stock's value while also factoring in the company's expected earnings growth and is thought to provide a more complete picture than the P/E ratio. A very attractive feature is it's dividend yield is 6.72% and is at the bottom range of a 5 month trading channel (chart).

In pre-market trading on Thursday 1-30-2020, it is down to $53, if you look at a 10 year chart, there is significant support at $50 and that would be my recommended buy point.

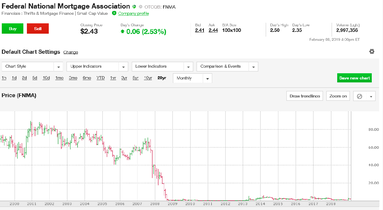

Stock Pick/Advice 12-15-2019

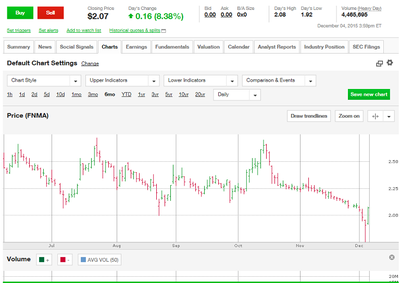

FNMA, Federal National Mortgage Association, also known as Fannie Mae is a government-sponsored enterprise chartered by Congress. The Company serves as a source of liquidity for purchases of homes and financing of multifamily rental housing, as well as for refinancing existing mortgages. Essentially it will purchase a mortgage from a bank, which frees up the banks money to give more mortgages. If you've recently financed, you know that banks make money from closing costs and if you look at your amoritization schedule, the most interest is paid in the 1st 2 years. This is typically when a bank sells a mortgage. Sine August of 2008, FNMA has been in government receivership since a bail out and all profits, in excess of billion dollars/year, have been going to the government. The Trump Administration has made overtures that FNMA should once again keeps it's profits and be able to distribute dividends to it's shareholders. This accounts for it's 250% run up YTD. If you notice the attached chart, FNMA has a 9 day winning streak where it advanced more than 25%. This is a result of a recent Federal Court decision that will allow shareholders to take the government to court in order to force the US government to relinquish it's hold on the mortgage giant. I believe this combined with a pro-business Trump administration will bode well for investors. (charts below)

Stock Pick/Advice 12-1-2019

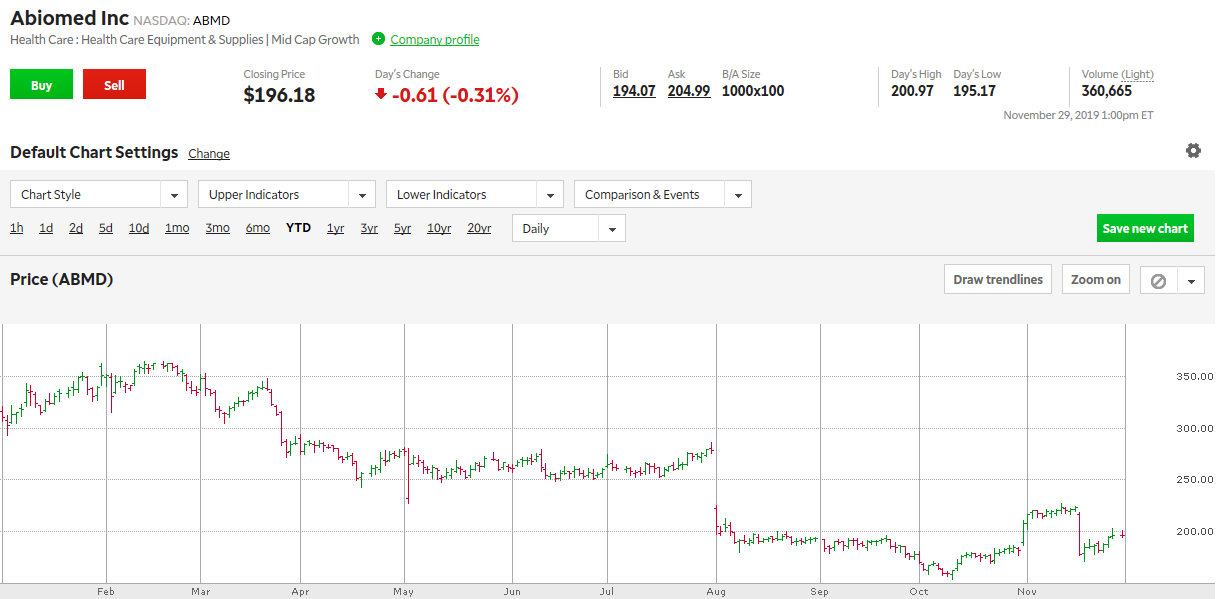

It's that time of year. The Santa Claus Rally refers to the tendency for the stock market to rally over the last two weeks of December into the New Year. A number of theories account for the occurrence: including increased holiday shopping, optimism fueled by the holiday spirit, or institutional investors settling their books before going on vacation. My Santa pick is Abiomed, ABMD, ABIOMED, Inc. is a provider of temporary percutaneous mechanical circulatory support devices. The Company offers care to heart failure patients. The Company operates in the segment of the research, development and sale of medical devices to assist or replace the pumping function of the failing heart. The Company develops, manufactures and markets products that are designed to enable the heart to rest, heal and recover by improving blood flow to the coronary arteries and end-organs and/or temporarily performing the pumping function of the heart. About 2 weeks ago, the stock sank 22% as a result of a study that suggested that its Impella heart device is associated with an increased risk of death, bleeding, and stroke among patients undergoing angioplasty to re-open clogged arteries. However, it appears that this study was jaundiced and it's author may have a conflict of interest. Since it's low of 50 point drop, it has recovered half of this and I believe that this will continue. CFRA still maintains a strong buy om Abiomed. Abiomed has been profitable for the last 5 years with a strong balance sheet.

Stock Pick/Advice 11-17-2019

By Market capitalization (price of a stock x shares outstanding) the IPO of Aramco is estimated to come in at $1.7 trillion, easily eclipsing Apple and Amazon. Aramco is the state owned, vertically integrated oil giant of Saudi Arabia. The purpose is to raise cash for Saudi Arabia so that it could reduce it's deficit and it is scheduled for next month.

Saudi Aramco said in a press statement Sunday morning that it’s hoping to sell a 1.5% stake in the company, or about 3 billion shares. The indicative price range for the shares is 30 Saudi riyals ($8.00) to 32 riyals, valuing the initial public offering (IPO) up to as much as 96 billion riyals ($25.60 billion) — at the top end of the range, according to Reuters.

The figure implies that the oil giant is worth between $1.6 trillion to $1.7 trillion. The IPO next month could beat the record $25 billion raised by China’s e-commerce firm Alibaba when it debuted in New York in 2014.Analysts’ valuations of the company have varied from $1.2 trillion to $2.3 trillion. In comparison, Aramco’s closest U.S. rival, Exxon Mobil, has a market cap of nearly $300 billion and Chevron is valued at about $229 billion. (CNBC).

Saudi Aramco said in a press statement Sunday morning that it’s hoping to sell a 1.5% stake in the company, or about 3 billion shares. The indicative price range for the shares is 30 Saudi riyals ($8.00) to 32 riyals, valuing the initial public offering (IPO) up to as much as 96 billion riyals ($25.60 billion) — at the top end of the range, according to Reuters.

The figure implies that the oil giant is worth between $1.6 trillion to $1.7 trillion. The IPO next month could beat the record $25 billion raised by China’s e-commerce firm Alibaba when it debuted in New York in 2014.Analysts’ valuations of the company have varied from $1.2 trillion to $2.3 trillion. In comparison, Aramco’s closest U.S. rival, Exxon Mobil, has a market cap of nearly $300 billion and Chevron is valued at about $229 billion. (CNBC).

Stock Pick/Advice 10-27-2019

Generac, (GNRC) is up 80% for the year (a 52 week and all time high) and I believe that there is more space to run, even when the P/E is 21. Generac s a designer and manufacturer of power generation equipment and other engine powered products. The Company serves the residential, light commercial, industrial, oil and gas, and construction markets. Its segments include Domestic and International markets. In case you're living under a rock, California, a population of 38 million, is experience power outages as a result of a strained delivery systems and raging wildfires.

PG&E is currently going through bankruptcy, and the company doesn’t seem to have an immediate solution for how to keep the power on when the threat of fire is high. So while PG&E falters, there could be much more upside ahead for Generac (CNBC). Generac Holdings CEO Aaron Jagdfeld said Friday on CNBC’s “Squawk Box.” “The (PG&E) CEO came out I think a couple of days ago and said a decade, it could be 10 years, of this kind of activity.” That said, he still likes the longer-term story. “We continue to like this dominant category leader and see several notable secular drivers here,” he added.

PG&E is currently going through bankruptcy, and the company doesn’t seem to have an immediate solution for how to keep the power on when the threat of fire is high. So while PG&E falters, there could be much more upside ahead for Generac (CNBC). Generac Holdings CEO Aaron Jagdfeld said Friday on CNBC’s “Squawk Box.” “The (PG&E) CEO came out I think a couple of days ago and said a decade, it could be 10 years, of this kind of activity.” That said, he still likes the longer-term story. “We continue to like this dominant category leader and see several notable secular drivers here,” he added.

Stock Pick/Advice 10-13-2019

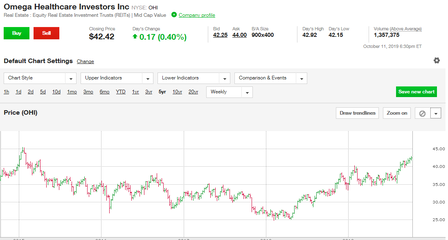

Health care stocks have taken a beating this year as a result of the partial gutting of Obamacare and this is one issue that has bi-partisan support in Congress, especially when it comes to the cost of prescription drugs. However, there is one area where the stocks are soaring and these are companies that provide old age housing, specifically assisted living facilities and nursing homes. Speaking from my own experience with my parents, a one bedroom assisted living apartment cost $9000/month and a 2 bed room in a full care nursing facility cost $17,000/month if you are self-pay, about half that if you are on medicaid. One such company is Omega Healthcare Investors, (OHI ticker). OHI is a self-administered real estate investment trust (REIT). The Company maintains a portfolio of long-term healthcare facilities and mortgages on healthcare facilities located in the United States and the United Kingdom. It operates through the segment, which consists of investments in healthcare-related real estate properties. It has been profitable for the past 6 years has a solid balance sheet, is at a 52 week high and approaching a 5 year high (chart). On top of this, it pays a dividend of, wait for it, 6.22%. It currently has an overweight rating by MarketWatch.

Stock Pick/Advice 10-6-2019

Westpac Banking Corporation (WBK) provides a range of banking and financial services in markets, including consumer, business and institutional banking and wealth management services. WBK is the second largest bank in Australia and it is a dividend play with a very healthy payout of 6.5%. please note, this is not a result of a huge price decline, As you can see by the accompanying chart, it has broken a medium downtrend resistance line and is establishing healthy support. Australian housing prices rose in September as the rebound in the country’s housing market continues to build momentum. Housing prices in Sydney and Melbourne rose by 1.7% in each city last month (Jim Jubak). What is particularly interesting in Australia is that they haven't had a recession in 28 years. This is a function of an economy with healthy exports of raw materials, primarily to China. Morgan Stanley has raised their target price to over $27/share which is significant given it's present price of under $20.

Stock Pick/Advice 9-22-2019

This weeks stock pick is going to be a value play that pays a goof dividend, One of the things you have to watch out for when picking a stock that pays a high dividend is the stock price of that stock. For instance, if you have a company that pays a $2 dividend and is selling for $100, the yield is 2%. However, if that stock decreases in price to $50, you now have a 4% dividend which looks like a deal, but if that stock continues its downward trend, your losses can far exceed the dividend. Given that, I like State Street Corporation, ticker, STT. State Street Corporation is a financial holding company. The Company operates through two lines of business: Investment Servicing and Investment Management. The Company, through its subsidiary, State Street Bank and Trust Company (State Street Bank), provides a range of financial products and services to institutional investors across the world. It's current dividend is 3.25%, with a strong balance sheet and a chart that's looks good from a technical standpoint since it broke a long trend resistance line and is establishing a support.

Stock Pick/Advice 9-07-2019

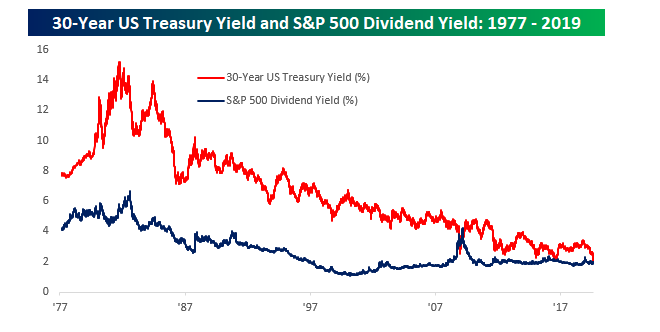

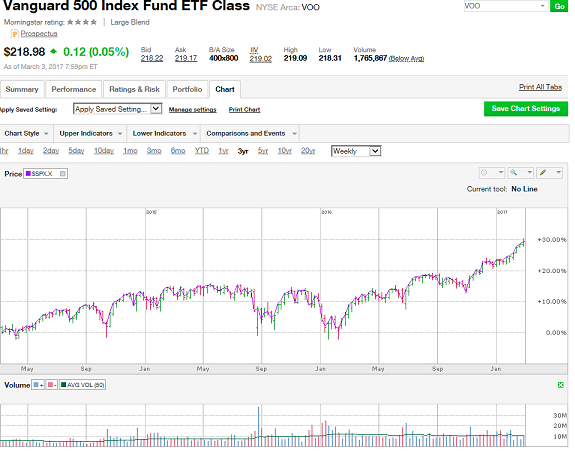

To say that August was tumultuous is an understatement ass consumer sentiment has decreased, the trade war continues and there still remains uncertainty on what the FED will do with interest rates. Typically, investors seek a safe haven which is typically gold, which is trading at $1530/oz or government bonds which investors consider to be risk free (bonds, not gold). However, with investors flocking to bonds, especially long term, that drives the price up and the yield down, with the 10 year yield at 1.49% and the 30 year equally the average dividend of the S&P 500 of 1.92%. So what's an investor to do? My near term fix would be a dividend ETF, Exchange Traded Fund. An ETF is similar to a mutual fund; it is a collection of securities—such as stocks—that tracks an underlying index. It is traded similar to stocks. My recommendation for the current investment climate would be a high yield ETF such as the Vanguard dividend Appreciation ETF, ticker VIG. The fund employs an indexing investment approach designed to track the performance of the Nasdaq US Dividend Achievers Select Index, which consists of common stocks of companies that have a record of increasing dividends over time. YTD (charts below), it has a return over 20% and pays a dividend of over 1.5%. This combines not only a respectable dividend that exceeds the 10 year yield, but a healthy return on investment that the 10 year doesn't.

Stock Pick/Advice 7-28-2019

This weeks stock pick is Vail Resorts, ticker symbol MTN. Vail Resorts, Inc. is a holding company. The Company operates through three segments: Mountain, Lodging and Real Estate. Its Mountain segment operates 11 mountain resort properties and approximately three urban ski areas, as well as ancillary services, primarily including, ski school, dining, and retail/rental operations. You may have read recently that Vail Resorts recently bought Wilcat and Attitash mountains in NH. In addition, they also own Sunapee in NH and Okemo in Vt. which were recently purchased. Vail caters to high end clients with most of it's upscale holdings in the Rockies. To no surprise, skiing is not a sport for the economically challenged given the price of lift tickets (over $100 on weekends at most of its resorts). As a matter of fact, the median household income of a skiing family is $86,000; compared to a median US household income of $61,000. Looking at the 5 year chart, they have had constant growth except for 2018. The reason for this was poor skiing conditions in the west. To combat this, they have diversified and extended their holdings to include eastern mountains. Rarely are ski conditions poor in both the West and the East; incidently, the US, both east and west. They pay a very respectable dividend of 2.85%, well above the yield on the 10 year, and have solid financials.

Stock Pick/Advice 7-21-2019

This week, we're going to look at PPG industries. PPG has two segments: Performance Coatings and Industrial Coatings. The Performance Coatings segment includes the refinish, aerospace, protective and marine, architectural businesses. The Industrial Coatings segment includes the automotive original equipment manufacturer (OEM), industrial coatings, packaging coatings, coatings services and specialty coatings and materials businesses. PPG just beat earnings and has a dividend of 1.75%. An analyst on CNBC, stated that their earnings were indicative of a good economy that will continue. However, Jim Cramer of CNBC see's a downturn because of a downturn in the auto industry. It seems that a number of other analysts agree and they have downgraded the stock, all-be-it from a strong buy to a buy. However, if you look at the 5 year chart of PPG, they have traded in a range from $90-$125. This is a stock that you may want to short and I'm putting it on the back burner for now.

Stock Pick/Advice 6-29-2019

The idea for this weeks stock pick comes from Jim Jubak, a previous vice president of CNBC. Vulcan Materials Company is a supplier of construction aggregates (primarily crushed stone, sand and gravel) and a producer of asphalt mix and ready-mixed concrete. The Company operates through four segments: Aggregates, Asphalt Mix, Concrete and Calcium. Jubak believes that in addition to it's regular business, it will see an uptick as a result of additional spending on seawall construction. He believes that this spending could eclipse over $400 billion over the next 20 years. Looking at the chart below, they have been in a 3 year trading range between $110-$140 and it is nearing the top of that range. Jubak feels that they are about to breakout. They have a strong balance sheet, a current ratio of 1.67 to 1 and a debt to equity of .88, and have been profitable over the past 5 years. Their cash flow is positive with most of the cash coming from operations

Stock Pick/Advice 6-16-2019

In 1956, there was an interesting Supreme Court case that involved DuPont. DuPont owned 100% of the cellophane market and was subsequently taken to court by the Justice department with the intent of breaking it into smaller pieces similar to Standard oil. However, DuPont came up with interesting defense. DuPont lawyers stated that they weren't in the cellophane market but in the flexible wrapping paper market and their competitors are aluminum foil, wax paper to mention a few. The Supreme Court bought the argument and DuPont did not have to diverse its holdings. Fast forward about 50 years to 2008 when Sirius and XM radio merged; there were some anti-competitive concerns that there would be a monopoly in the" pay for play" radio business. However, both companies were quick to point out that they weren't in the pay for radio business, but the entertainment business and their competitors were other radio stations, TV etc. As a result, the merger was allowed.

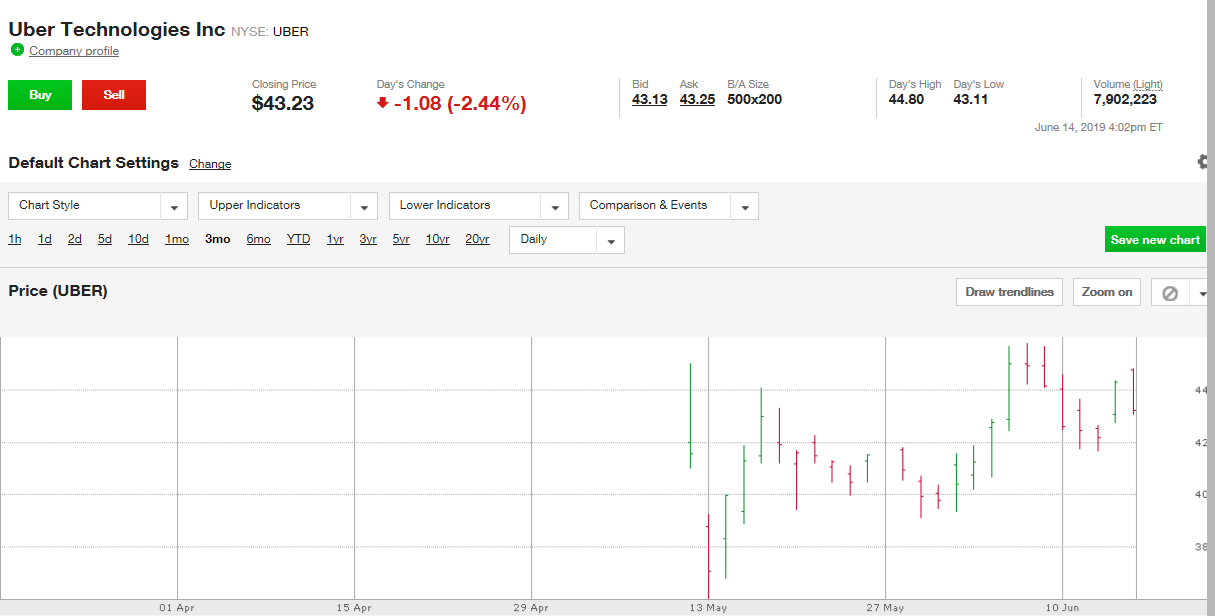

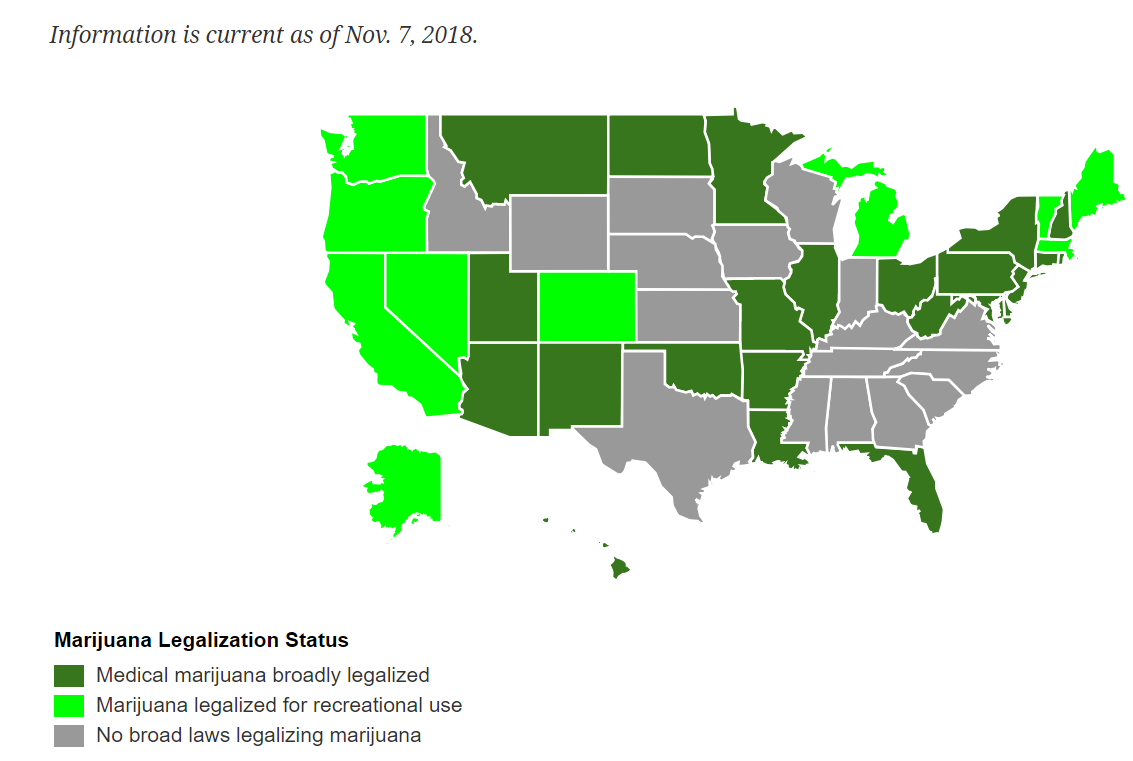

Fast forward to this year and UBER and Lyft and their IPO's. Both companies are down from their IPO prices and both companies are losing money. There little doubt in my mind that these companies will eventually merge and there will be antitrust concerns but they will be quickly brushed aside with the argument that these companies are in the transportation business with their competition being taxi's, buses and RR's to mention a few. At this time I believe they will realize profitability and a higher stock price. The trick will be to anticipate when this will happen. As nothing more than a guess, I'll estimate 1-3 years.

As an addendum, to illustrate they they are getting a significant market share, taxi medallions in Boston have decreased in value from a high of $700,000 to a low of $40,000 before settling at $100,000.

Fast forward to this year and UBER and Lyft and their IPO's. Both companies are down from their IPO prices and both companies are losing money. There little doubt in my mind that these companies will eventually merge and there will be antitrust concerns but they will be quickly brushed aside with the argument that these companies are in the transportation business with their competition being taxi's, buses and RR's to mention a few. At this time I believe they will realize profitability and a higher stock price. The trick will be to anticipate when this will happen. As nothing more than a guess, I'll estimate 1-3 years.

As an addendum, to illustrate they they are getting a significant market share, taxi medallions in Boston have decreased in value from a high of $700,000 to a low of $40,000 before settling at $100,000.

Stock Pick/Advice 4-28-2019

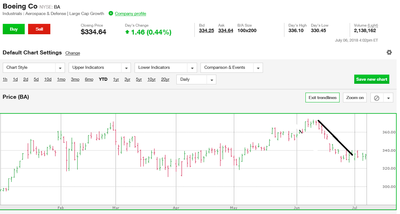

I believe it's time to buy Boeing. As a result of two 737 MAX crashes, the entire fleet has been grounded and is expected to come back on line within a month. As a result of the grounding the stock has dropped 15% and despite the negative sentiment, it is holding at the 375-380 level where there is support. Despite the safety problems as a result of deficient software, Boeing still remains viable and actually increased from after its earnings release last week. Boeing said that it expects to lose $1 billion in sales as a result of the MAX being taken offline. However, given last years sales of over $101 billion (that's right billion with a B), the effect is not significant. In addition, as a result of the price drop, it's dividend has increased to over 2% which makes it attractive given a saving rate at most banks at .25-.5%. In addition, 25 analysts polled by MarketWatch give it a 1 year target price of $442 and an overweight rating.

Stock Pick/Advice 4-21-2019

Don't ever confuse brains with stock market movements. It's been a rough month of April for healthcare stocks with democratic hopeful candidates Bernie Sanders, Elizabeth Warren and Kamala Harris advocating medicare for all. What also adds to the fear factor is the house being controlled by democrats with the tail, extreme liberal democrats, occasionally wagging the dog.

There are several Medicare for All proposals circulating in Congress, some of which would basically abolish private insurance while others would simply create a public option and leave private plans largely in place. Still, the industry is worried. On Tuesday, UnitedHealth CEO David Wichmann said Medicare for All would “destabilize the nation’s health system (CNN).

I simply don't see this happening with a republican Senate and Trump as president. But as usual, the market overreact. United Health Care, UNH ticker, At $221, UNH is 20% off its highs and, to me, represents a screaming buy. However, there may be more pain and if the stock went down to $200 on more panic selling, there is some support at that level and at this point, sanity may prevail. What else makes the stock attractive is a dividend yield of 1.62%

There are several Medicare for All proposals circulating in Congress, some of which would basically abolish private insurance while others would simply create a public option and leave private plans largely in place. Still, the industry is worried. On Tuesday, UnitedHealth CEO David Wichmann said Medicare for All would “destabilize the nation’s health system (CNN).

I simply don't see this happening with a republican Senate and Trump as president. But as usual, the market overreact. United Health Care, UNH ticker, At $221, UNH is 20% off its highs and, to me, represents a screaming buy. However, there may be more pain and if the stock went down to $200 on more panic selling, there is some support at that level and at this point, sanity may prevail. What else makes the stock attractive is a dividend yield of 1.62%

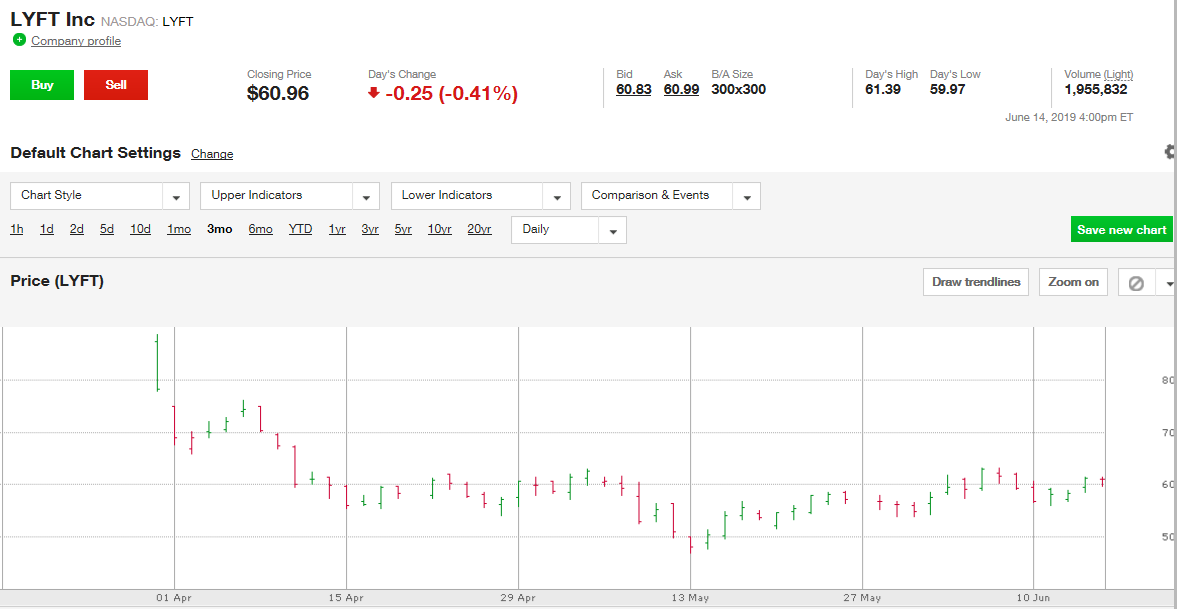

Stock Pick/Advice 3-31-2019

Even tho it's 20% off it's highs, Skyworks Solution has much to gain from a US/China trade deal, since it does much business with Apple and the trade was is adversely affecting sales. Apple represents almost 50% of Skyworks sales. Skyworks builds wireless chips that, today, primarily go into smartphones. Smartphones should continue to play an important part in Skyworks' future, especially as the transition to 5G wireless drives up the value of the chips that Skyworks sells to its smartphone customers, but the company is also looking to diversify into automotive and other Internet of Things (IoT) markets, too. It has an attractive p/e at 13.6 and pays a respectable dividend of 1.85%. Indeed, according to the company, a typical 3G smartphone had about $8 of Skyworks content, a figure that grew to $18 for a 4G smartphone. The company claims that number is set to rise again to $25 for a typical 5G smartphone (CNBC). According to MarketWatch, it is rated a buy from the 30 analysts who cover the stock with a 1 year target price close to $90.

Stock Pick/Advice 3-10-2019

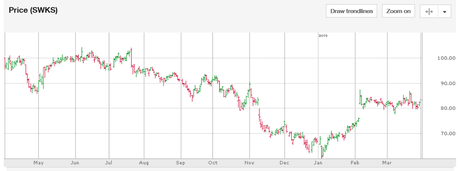

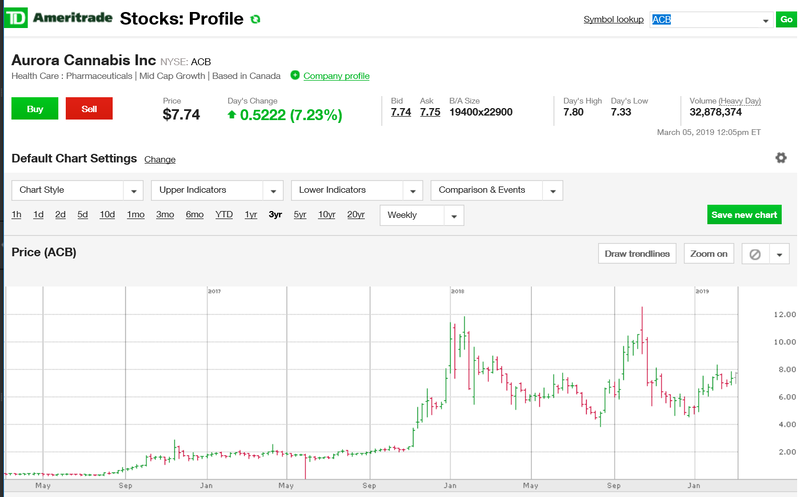

A number of people have asked me what are good cannabis stocks to buy. None comes right to mind. The problem is that even tho 33 states (map below) have legalized some form of marijuana, it is still illegal federally. As a result, most dispensaries will not receive any loans or other considerations from banks and they operate on a mainly cash basis which limits expansion. Friends and students have asked me what about Canada where it is legal on a federal level. That's all well and good, but Canada has only 37 million people (less than California) that are spread out over a country larger than the United States. Generally, if someone wants marijuana in Canada they will grow it themselves so the industry is not thriving. If you must and are gambling on legalization, I would recommend Philip Morris or Molsen-Coors since they are already established sin stocks and could weather any enforcement on a federal level if we were to get a President or US Attorney General who chose to enforce those laws in states that have legalized the substance. However, if you must invest in a Cannabis stock, I would suggest (not recommend) you look at Aurora Cannabis, ticker ACB. It has just shown a profit for the 1st time in 5 years and is a Canadian based company over 1.2 million pounds of cannabis. It has just been recommended by Cowen Investments with a price target of $10.50. According to Cowen, they are expected to generate $305 million Canadian ($227 American) in fiscal 2019 and are located in 23 countries.

Stock Pick/Advice 3-3-2019

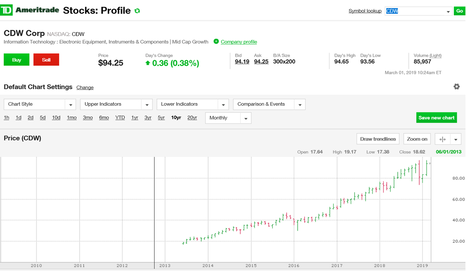

Between the NYSE and the NASDAQ, there are over 6000 stocks on those exchanges so it is impossible to cover everything, not to mention the pink sheet penny companies. This weeks stock pick is CDW, a company which isn't on many analysts radar but has had 6 years of steady growth since it went public in 2013. It is a provider of integrated information technology (IT) solutions in the United States, Canada and the United Kingdom. The Company's segments include Corporate, Public and Other. The CDW Advanced Services business consists primarily of customized engineering services delivered by technology specialists and engineers, and managed services that include Infrastructure as a Service (IaaS) offerings (Ameritrade). It has a strong balance sheet with $1 billion in equity and a current ratio of about 1.4. It has also realized a profit since it went public and that profit has increased by 60%. It pays a 1.26% dividend and has a P/E of 22 which is above the S&P 500 average of about 17, but given its growth I feel is well Justified.

Stock Pick/Advice 2-10-2019

This weeks stock pick is risky, but it could yield great returns and the downside is marginal. Federal National Mortgage Association (Fannie Mae), FNMA, was established in the 1930's to stimulate home growth. They buy mortgages from banks within the first few years (when the interest return is is greatest for the banks), thus freeing up the banks money in order that they may give out more mortgages. Until the financial crisis of 2008, they enjoyed a healthful life trading as high as $80 before the real estate bubble burst and they were placed in receivership after being bailed out by the government for $191 billion. Since that time, they have returned all their profits, $292 billion, to the US government and shareholders have received nothing, hence the low stock price which has fluctuated between $1-$4. Enter the business friendly Trump government that has talked about taking them out of receivership and thus returning profits to shareholders in the form of dividends. Recently, the stock price has jumped from $1 to $3 before pulling back on verbiage from Treasury Secretary Mnuchin and the President indicating they want to unprivatize the mortgage giant. I feel that this will be a matter of time and it will eventually happen which will bode well for stockholders. In the event that this does occur, I see the company easily reaching a stock price in the 20's.

Stock Pick/Advice 2-3-2019

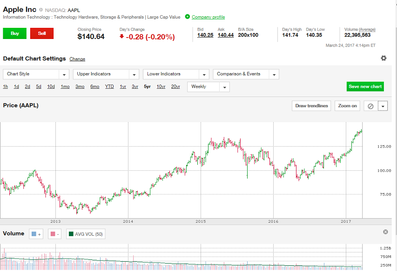

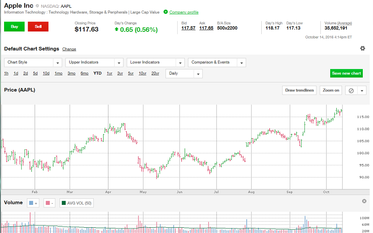

Apple beat earnings by 1 cent/share. That doesn't seem like much, but if you have 4.7 billion shares outstanding, that's $470 million. It did guide lower in expectations, but not as low as anticipated, and if Chinese and American trade negotiators come to an agreement it is off to the races. Apple was up 12 points yesterday and broke to resistance lines. I believe it presents an excellent buying opportunity. Adding to the party was the FED statement after it's 2 day FOMC meeting. FED chair Jerome Powell indicated that the inflation dragon is under control, and given present metrics, he sees, at most, only one rate hike this year. As of Friday, Apple was trading at $168/share and assuming trade differences between the US and China are resolved, I see Apple testing its 52 week highs of 230.

Stock Pick/Advice 1-6-2018

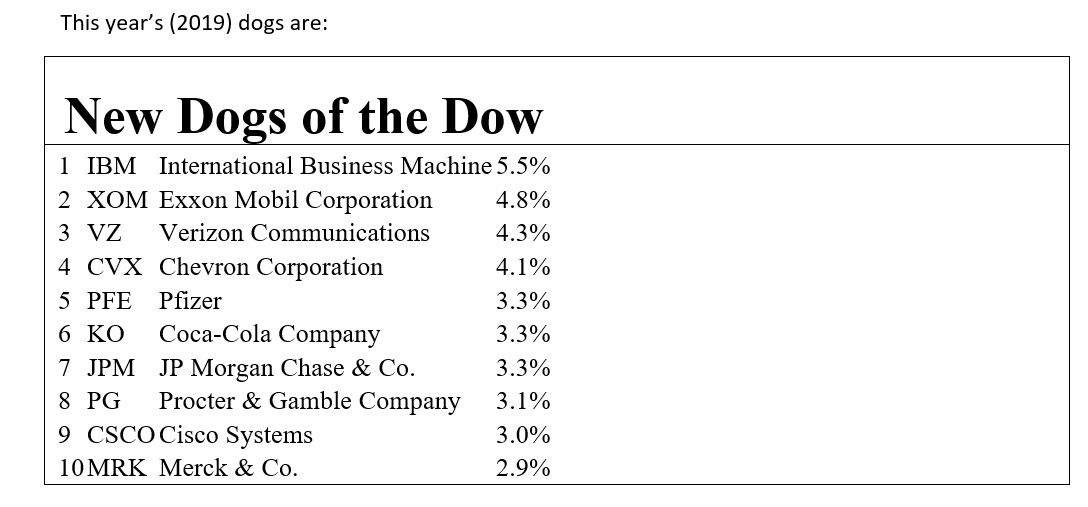

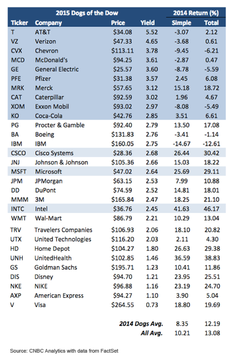

The Dogs of the Dow was 1st popularized my Michael Higgins in 1991. Based on the Theory Companies don’t alter dividends based on trading fluctuations, i.e., the dividend amount remains constant but not yields, therefore, as price decreases, the yield increases. The assumption is that companies have a repeating cycle of good/bad performance and that there is good management which causes the companies to recover. The dogs of the Dow are ten companies that have the highest dividend yields that occurred as a result of falling stock prices.

This year’s (2019) dogs are:

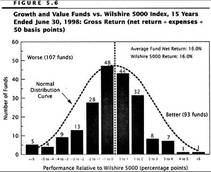

During the past 20 years the Dogs have slightly outperformed the Dow; however, another trading strategy is the “small” dogs of the Dow were you purchase the top 5 dividend stocks. This strategy has outperformed the Dow in the past 20 years by yielding a 13% return as opposed to an 11%.

This year’s (2019) dogs are:

During the past 20 years the Dogs have slightly outperformed the Dow; however, another trading strategy is the “small” dogs of the Dow were you purchase the top 5 dividend stocks. This strategy has outperformed the Dow in the past 20 years by yielding a 13% return as opposed to an 11%.

Stock Pick/Advice 12-16-2018

I believe that a hidden gem is the airline industry in particular, and the transportation industry in general for the very simple reason that fuel costs are down 25% in the past quarter. Every 1 cent change in the price of a barrel of oil equates to a $180 million dollar change for the industry. Given that oil has fallen $18/barrel from it's high, well you can do the math for the cost savings, ok I'll do it, $324 billion that the industry has saved. Couple that with a low unemployment rate, 3.7%, equates to people having money to travel. My favorite airlines are Alaska air, Southwest, Jet Blue and Delta. However, if you can't decide, by the transportation ETF , ticker XTN. It is at a year to date low, like the Dow, but I believe, like the Dow, this will recover when trade issues are resolved with China, and it will have the extra impetus of profits.

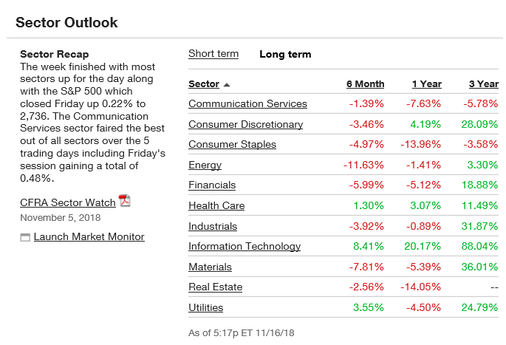

Stock Pick/Advice 11-18-2018

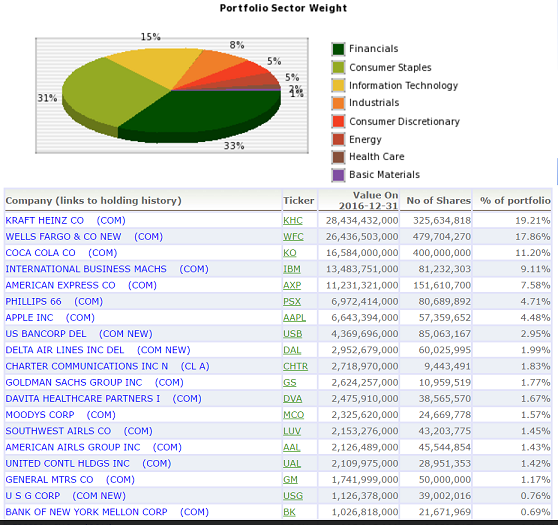

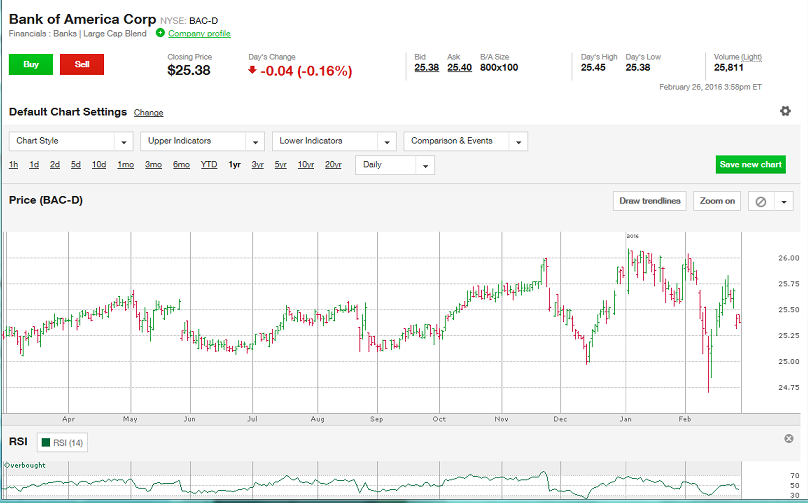

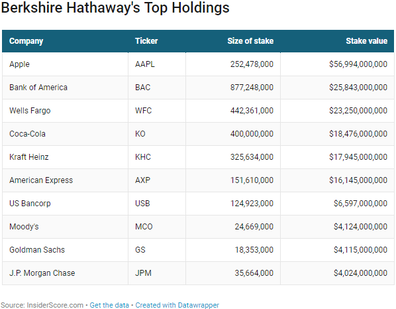

He is the Oracle of Omaha. Be fearful when others are greedy and Greedy when others are fearful. Great advice from Warren Buffet. When truly great stock buying strategy is to see what Warren Buffet is buying and selling and emulate that. If you look at the financial sector, you will see that they are down 6% in the past 6 months (chart below). This is surprising since bank stocks typically do well in a rising interest rate environment (higher profits). The demand for money (loans) is generally inelastic, so when the cost goes up (higher interest rates), the demand goes down (less loans), but as a result the higher interest rate, revenues/profits increase. I believe, like Buffet (and I'm sure he sleeps better at night knowing that I agree with him) that the sector is oversold as a result of global trade war concerns and a flattening yield curve (interpretation is recession fears).

Pro outlooks for the sector include good dividends, the range is 1.6% to 3.25%, an end to the trade war, rising interest rates, the possibility of less regulation prior to dem's taking control of the house and no further regulation in the next 2 years and the distinct possibility of 3% GDP for the year.

Pro outlooks for the sector include good dividends, the range is 1.6% to 3.25%, an end to the trade war, rising interest rates, the possibility of less regulation prior to dem's taking control of the house and no further regulation in the next 2 years and the distinct possibility of 3% GDP for the year.

Stock Pick/Advice 11-4-2018

About 1 year ago I recommended Apple when it was under$180/share. Since that time it soared to $230/share and became the 1st company to reach a $1 trillion market cap (price of the stock times shares outstanding). During the past month, the FAANG stocks, along wit the tech sector has sunk over 4%, however, Apple has given up almost 13%, in part because of sympathy with the sector, but half of its loss occurred on Friday after it announced that iphone sales last quarter didn't match estimates. It also announced that it expects record holiday sales this year and that, in part, is what I'm basing my recommendation on. The other reasons are that I believe the market will recover greater once a trade deal is worked out with China, and I believe that is inevitable and just basics. We are at a 3.7% unemployment rate, the lowest since 1969, wages have increased by 3.1%, the best since 2009, inflation is in check, 2%, and consumers have money to spend, and as a result, I believe that Apples prediction of better iphone sales will come to fruition.

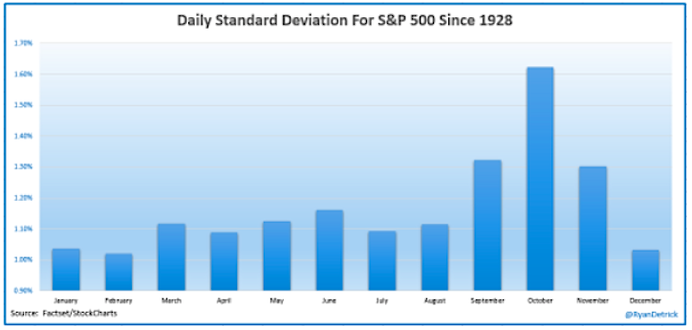

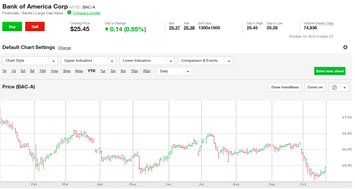

Stock Pick/Advice 10-21-2018

Given the volatility in the market over the past month, this week's pick is going to be a conservative but profitable pick. A preferred stock is a class of ownership in a corporation that has a higher claim on its assets and earnings than common stock. Preferred shares generally have a dividend that must be paid out before dividends to common shareholders, and the shares usually do not carry voting rights. Dividends are also much higher than dividends on common stocks. This weeks pick is a Bank of America preferred stock, BAC-A that is paying out a close to 6% dividend. It is callable st $25 and is currently trading well off it's 52 week high at $25.45. This is the type of investment that you use to diversify your portfolio and it far exceeds inflation and the opportunity cost of money in a savings or money market account.

Stock Pick/Advice 9-23-2018

If you look at Boeing's stock since June it has been in an up/down trading cycle compliments of a trade war started by this administration. If the trade outlook is pessimistic down it goes and when optimistic, you guessed it up it goes, same as the Dow. However, both the Dow and Boeing are close to all time highs, on, for now, optimism about the trade wars ending. Boeing, along with Caterpillar, are bellwethers for international trade. Currently, Boeing has well over $100 billion in orders to fill and once the war is over, and I suspect trade agreements will be reached prior to elections in November (we already reached one with Mexico and we are close with Canada, it will be off to the races. So the decision is simple, if you think the trade war will continue, wait until Boeing hits the bottom of it's trading channel at $325, if not, I think it's a buy.

Stock Pick/Advice 9-2-2018

It has been out of favor since September or 2008 when it required a government bailout of over $180 billion and its stock dropped by 99%. But, with a stock price of $53, trading well below it's book value of $70, a solid cash position, and a 2.41% dividend, AIG is a diamond in the rough. It is significantly undervalued and I don't see it becoming a darling anytime soon. What I do see is the opportunity for a short term profit. What of the many strategies I employ, is to find stocks that are trading in a channel and buy low and sell high. I'm not the only person who does this, so many times, it becomes a self-fulfilling prophesy. AIG has been trading between 52-56, simply wait for the low and sell at the high, and you may end up with a dividend somewhere in between. In the long run, I believe this stock should be trading well above it's book value, but that may be a while.

Stock Pick/Advice 8-26-2018

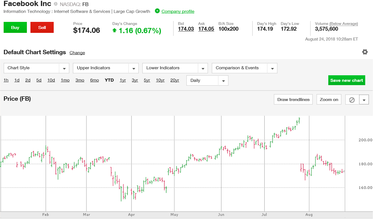

Buy low, sell high. It's time to buy Facebook. After it disappointed in earnings it dropped to a low of $166/share down from an all time high of $219. It since recovered to $188 (sucker rally) and it appears that it has stabilized at $174. I like the company and the ad revenue continues in the midst of a strong economy (see updates/advisories 8-24-2018). Of the 48 analysts that follow Facebook on MarketWatch, it has a buy recommendation with an average one year target price of $206. Also according to MarketWatch, Facebook is one of fifteen companies that is investing the most in "Tommorrow's Big Idea's". They also go on to say that each of these companies have strong capital positions and gave invested more than $2.5 billion this year alone in upcoming technology. Reacting to market opportunities is the biggest reason companies invest in R&D, not the cost of capital. But the tax cut might also be accelerating some R&D, because the law will require amortization of R&D beginning in 2022.

Stock Pick Advice 7-29-2018

To say that Hi-Crush Limited Partnership ,HCLP, is on a tear is an understatement. Hi-Crush produces sand that is used in the fracking process, and with US oil production at an all time high, 11 million barrels/day (42 gallons in a barrel), business is booming.

HI-Crush is a MLP, Master Limited Partnership. It combines the tax benefits of a limited partnership with the liquidity of publicly traded securities. The vast majority of MLPs are pipeline businesses, which earn very stable income from the transport of oil, gasoline or natural gas. Energy MLPs are defined as those owning energy infrastructure in the United States. Limited partnerships that trade on securities markets like normal stocks. MLPs are not subject to income tax, and shareholders in MLPs are actually "limited partners" in company. Their special tax designation allows MLPs to pass the tax burden onto their shareholders, but they are required to pay the vast majority of their earnings out to their partners.

HCLP has broken out of a 4 month trading range dramatically with the impetus being a huge increase in dividends from 22.5 cents/hare to 75 cents per share on a quarterly basis ($3/year/share). What is particularly interesting is that the dividend increase for the 2nd quarter was announced on July 23, BEFORE it announced 2nd quarter earnings which are scheduled to be released on August 1. I suspect, that even to a blind man, if they announced this huge of a dividend increase, earnings should be a blow away figure. The current dividend yield is over 20%.

HI-Crush is a MLP, Master Limited Partnership. It combines the tax benefits of a limited partnership with the liquidity of publicly traded securities. The vast majority of MLPs are pipeline businesses, which earn very stable income from the transport of oil, gasoline or natural gas. Energy MLPs are defined as those owning energy infrastructure in the United States. Limited partnerships that trade on securities markets like normal stocks. MLPs are not subject to income tax, and shareholders in MLPs are actually "limited partners" in company. Their special tax designation allows MLPs to pass the tax burden onto their shareholders, but they are required to pay the vast majority of their earnings out to their partners.

HCLP has broken out of a 4 month trading range dramatically with the impetus being a huge increase in dividends from 22.5 cents/hare to 75 cents per share on a quarterly basis ($3/year/share). What is particularly interesting is that the dividend increase for the 2nd quarter was announced on July 23, BEFORE it announced 2nd quarter earnings which are scheduled to be released on August 1. I suspect, that even to a blind man, if they announced this huge of a dividend increase, earnings should be a blow away figure. The current dividend yield is over 20%.

Stock Pick/Advice 7-15-2018

After being hammered for the past 3 years and poor management from bio-reference labs, and disappointing initial sales from a potential blockbuster drug, Rayaldee, OPK has been up for the past 7 weeks, increasing 100% and is close to a YTD high. The turn around came with an earnings beat for quarter 1 and better than expected sales for Rayaldee. RAYALDEE is a vitamin D3 analog indicated for the treatment of secondary hyperparathyroidism in adult patients with stage 3 or 4 chronic kidney disease. What is particularly significant about this drug is it's low p-value .01, which indicates a statistically significant effect coupled with minimal side effects. From a technical viewpoint, it has broken a long term downward sloping trendline (see 5 year chart) coupled with an increasing trendline. Quarter 2 earnings, are due out in August. Doing a fundamental analysis, I still believe this is a $25 stock. Rayaldee sales are up 730% year over year.

One warning sign is a decreasing cash flow which could result in an issuance of stock.

One warning sign is a decreasing cash flow which could result in an issuance of stock.

Stock Pick Advice 7-8-2018

As a result of trade concerns and the beginning of a trade war, Boeing has lost 10% of it's value in the past month, but it has been topped by Caterpillar that has lost 15%. Both companies have significant exports to China and stand to lose a fair amount in revenues and profits as a result of higher tariffs. Both companies have dividends in excess of 2% and both companies have very solid balance sheets, and most importantly, both companies will regain the lost stock price within a week if/when the trade war comes to an end and it will, all trade wars do since free trade is highly beneficial. The trick to this will be timing as when to jump in. I'll be watching the news closely and jumping in when I 1st feel that both countries come to their senses. I give it 2 weeks

Stock Pick/Advice 6-26-2018

As Jim Cramer often states, there is always a bull market somewhere. It then begets the question, where do we invest during a trade war? The quick answer is safe haven assets. The most common is US government bonds, however, this generally raises the price of bonds and, in turn, lowers the yields. The current yield on the 10 year is down to 2.87% Gold or gold stocks are generally a safe haven, but gold, surprisingly, is trading at 6 month lows at $1257/oz. The reason for the lower gold prices is that investors seem to believe that the trade war will be short lived in anticipation of higher interest rates from the FED that will keep inflation in check. Probably the best trade is utility stocks that pay high dividends such as Verizon, AT&T, Duke Energy and Consolidated Edison; or quite simply, I would recommend the utility ETF (chart).

An ETF, or exchange-traded fund, is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold.

An ETF, or exchange-traded fund, is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold.

Stock Pick/Advice 4-29-2018

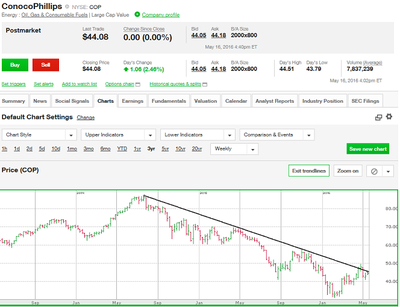

Is it time to buy oil stocks. Over the past 3 years, the energy sector has been be beaten down as has been the price of oil. The sector is down over 16% for the 3 year period, however, the price of oil is currently at 3 year highs, compliments of a worldwide increase in demand and mid-east unrest, and the sector is following as it is up over 6% in the past 6 months. US oil production is up to record levels and is expected to reach 11 million barrels/day by the end of the year. It then begets the question, what stocks to buy. The reason that oil production has doubled since 2005 is fracking technology and there are a number of stocks in that area; High Crush Limited Partnership, which supplies sand for the fracking process (and pays a 7.5% dividend), it has a buy rating from MarketWatch with a 1 year target price of $17 (current price is $12); another stock in this area is Silica holdings that has a MarketWatch rating of overweight, pays a 1% dividend and a 1 year target price of $37 from its current price of $30. A previous high flying stock that barely escaped bankruptcy is Ultra Petroleum. Ultra Petroleum Corp. (Ultra) is an oil and gas company. The Company is engaged in the development, production, operation, exploration and acquisition of oil and natural gas properties. Its principal business activities are developing its natural gas reserves. It is ranked as an overweight by MarketWatch and is at a 1 year low, however, it has surpassed production expectations in the past quarter and has an optimistic outlook, but at under $3/share, it is a risk play but with a lot of upside.

Stock Pick/Advice 4-22-2018

It's the stock that you love to hate, AIG. Harbinger of the fiscal crisis and recipient of a huge government loan. The company/stock is doing well. It was on the brink of Chapter 11 in October of 2008, and by September of 2009, they were rated as the 3rd safest insurance company in the United States. In addition, their government loan was paid off within 3 years with interest. They pay a dividend of 2.3% and theirs book value (Equity/sharesoutstanding) is $72/share, 31% higher than the current stock price of $55. In addition, they have just broken a resistance line and is showing good support.

Stock Pick/Advice 4-8-2018

Based on technical analysis (which judges market psychology) and some common sense, I think it's time to buy Facebook. It is off 19% in a month as a result of member information being obtained and used by Cambridge Analytics. I think the selloff is a huge over-reaction given the 1 billion people worldwide who use the platform, and look at the platform, if you don't want your information disseminated, don't put it out there, but that's the purpose of FB, to stay in touch and

re-engage with friends and family. Like everything else and I believe its current price is a buying opportunity. Looking at the chart, it has broken a short term resistance line and is trading sideways (consolidation). I see its next resistance point at 180. Of 45 analysts who cover Facebook on MarketWatch, it is ranked a buy (a higher rating than overweight) with an average 1 year target price of $218. Of the 45 analysts, only 2 rate it as underweight or sell.

re-engage with friends and family. Like everything else and I believe its current price is a buying opportunity. Looking at the chart, it has broken a short term resistance line and is trading sideways (consolidation). I see its next resistance point at 180. Of 45 analysts who cover Facebook on MarketWatch, it is ranked a buy (a higher rating than overweight) with an average 1 year target price of $218. Of the 45 analysts, only 2 rate it as underweight or sell.

Stock Pick/Advice 4-1-2018

In 1985, 45% of the population n the United States smoked cigarettes. After the turn of the century, it was down to 24% and it is currently 16%. However, over 1 billion people worldwide smoke cigarettes and Phillip Morris international, and its sister corporation Altria, formerly Phillip Morris, is a huge international corporation where the top 3 tobacco firms control over 50% of the market. In the past year, the stock has dropped over 20% on an earnings miss and a number of downgrades. However, it remains a cash rich stock with a strong balance sheet with a current dividend of 4.5%. It is a well respected company with a short interest of 1% which indicates that the stock is hugely oversold. It is considered a defensive stock (it will do well in a recession) with a beta of .7. In addition, it just received a buy rating from Deutsche bank and of the 19 analysts that follow Phillip Morris International on MarketWatch.com, it has an average rating of overweight with a 1 year target price of $120.

Stock Pick/Advice 3-18-2018

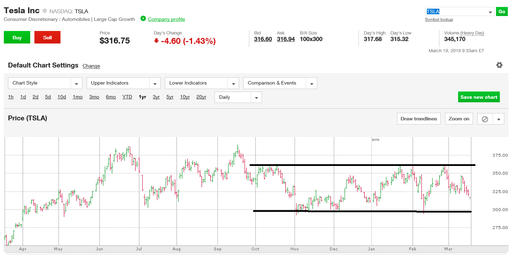

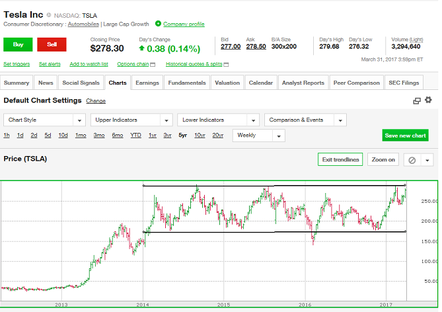

This is going to hurt, but it may be time to buy Tesla, and it is based purely on technical analysis. There are many trading strategies that traders use, the best is probably Warren Buffets value buy and hold, and my recommendation on Tesla is based on the fact that it has been in a "trading Channel" since last October. If you look at the accompanying chart, Tesla, since last year has been trading in a rang from about $300 to $360. Since I'm not the only one doing this, it often times becomes a self-fulfilling prophecy in lieu of any significant news such as an earning surprise. On the plus side, this is generally a period of consolidation before a higher run; but like everything else, it's not an exact science. So, I will be looking to buy Tesla at $300 and sell it in the $350 range

Stock Pick/Advice 1-21-2018

About 3 years ago, I recommended Hi-Crush Materials when it was in it's 20's. It climbed to the high 60's and fell when the price of oil went down to a low of under $5. Now it is on the rebound and I think it has room to run. Hi-Crush Partners LP is an integrated producer, transporter, marketer and distributor of monocrystalline sand, a specialized mineral that is used to manage the recovery rates of hydrocarbons from oil and natural gas wells (fracking). Its reserves consist of northern white sand, a resource in Wisconsin and limited portions of the upper Midwest region of the United States. With the increase in the price of oil, more fracking wells have re-opened and business has increased. They have re-instated their dividend and increased the disbursement this quarter The current dividend yield is 6.5%. Despite the recent gains, HCLP has fallen 36.2% over the past year. That could make the fracking sand producer a promising MLP for 2018. HCLP is expected to benefit from low leverage and strong earnings growth. The partnership ended the third quarter of 2017 with a net debt-to-EBITDA of 2.4, which is well within the industry standards. About 85.7% of analysts rate HCLP a “buy” as of January 5, 2018, while the remaining 14.3% rate it a “hold.”(marketwatch).

Stock Pick/Advice 1-06/2018

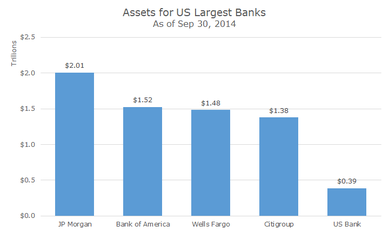

How do you pick a rose from the Garden of Eden. That's how some people feel on what to buy given this incredible bull market. Unless there is a shock to the economy (such as a big bomb going off), I see a continued bull market for 2018 in a slightly rising, FED fueled interest rate environment. What more than makes up for this is the Corporate tax cut from 35% to 21% which has the effect of increasing corporate taxes by 21%, and a president who wants to reduce regulation which generally results in further cost savings. Giving the aforementioned, I like the financial sector, particularly the big banks. My favorites are Bank of America, US Bank corp and of course JPMorgan. The demand for money is inelastic (in other words, as rates rise, revenues to banks increase sine the % increase price is greater than the % decrease in quantity), and in a rising interest rate environment, banks historically benefit, particularly in a healthy demand-pull economy. In addition, with the excess cash from a tax cut, it is a reasonable expectation that these banks will increase their already healthy dividends and have stock buyback programs. If you have difficulty deciding, I would recommend the Vanguard Financial ETF which has a nice upward bias and dividend that I believe will continue.

Stock Pick/Advice 12-24-2017

Since the Republican tax plan has passed, you can expect to see a big increase in M&A (Mergers & Acquisitions) activity. This year there was under 35 M&A's that totaled barely $40 billion. However, the biotech industry stands to gain as a result of favorable tax changes. It's anticipated by a number of the larger drug companies will repatriate money and other assets held overseas and will be better able to compete with their foreign counterparts (in case you've been living under a rock, the US corporate tax rate is dropping from 35% to 25% which will increase after tax profit by over 20%). Among the potential take-out targets singled out by JMP Securities, are Madrigal Pharmaceuticals, Heron Therapeutics, Adamas Pharmaceuticals and Marinus Pharmaceuticals.

I particularly like Madrigal Pharma. Madrigal Pharmaceuticals, Inc., formerly Synta Pharmaceuticals Corp., is a clinical-stage biopharmaceutical company. The Company focuses on the development and commercialization of therapeutic candidates for the treatment of cardiovascular-metabolic diseases and nonalcoholic steatohepatitis (NASH). As a result of a number of successful completions (phase 2) of drugs, the companies stock has skyrocketed. Market watch analysts give this a buy recommendation with an average target price of $135.

I particularly like Madrigal Pharma. Madrigal Pharmaceuticals, Inc., formerly Synta Pharmaceuticals Corp., is a clinical-stage biopharmaceutical company. The Company focuses on the development and commercialization of therapeutic candidates for the treatment of cardiovascular-metabolic diseases and nonalcoholic steatohepatitis (NASH). As a result of a number of successful completions (phase 2) of drugs, the companies stock has skyrocketed. Market watch analysts give this a buy recommendation with an average target price of $135.

Stock pick/Advice 11-26-2017

Wait for it. AT some point I think GE will be a buy (all bets are off if Congress doesn't pass a tax plan) but not just yet. The stock is down almost 50% this year and they have cut their dividend in half, the largest since the great depression. To make matters worse, it's the end of the year, and in a market that has gone up over 20%, many investors will be looking to minimize their tax liability by selling off their losers, and GE is at yearly lows. On the plus side, GE has a long history of success and bouncing back and I think this will be no different, but I'm not a buyer until it reaches the $13-$14 range.

Stock Pick/Advice 10-29-2017

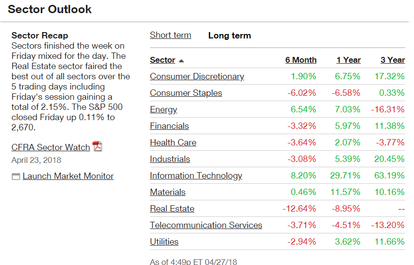

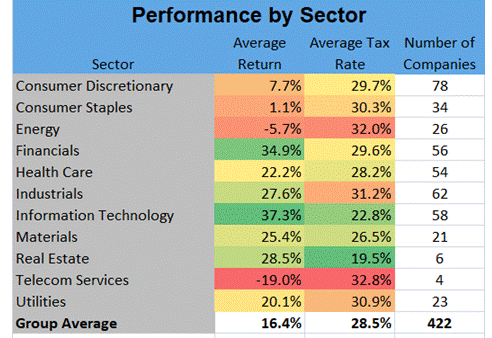

With what appears to be an imminent cut on the corporate tax rate, there will be a number of companies that will benefit significantly, however, what many investors are unaware of is that some sectors will benefit more than others. The three main sectors (attached chart) are consumer discretionary, Consumer staples and energy. The next question to come to mind is what would be the best stocks. Well stock picks are like noses, every analyst has one. The best way to play this would be to buy the sector ETF (Exchange Traded Fund). An ETF is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold. ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors.

Given the above, I like the following: for consumer discretionary, VCR the Vanguard Consumer Discretionary Index Fund, for Staples, XLP, Consumer Staples Select Sector, the fund employs a replication strategy. It generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index. The index includes securities of companies from the following industries: food and staples retailing; household products; food products; beverages; tobacco; and personal products; and for the energy sector, VDE, Vanguard Energy Index Fund (I generally like anything from Vanguard), the 3 month return is 7% and a 10% one month return.

Given the above, I like the following: for consumer discretionary, VCR the Vanguard Consumer Discretionary Index Fund, for Staples, XLP, Consumer Staples Select Sector, the fund employs a replication strategy. It generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index. The index includes securities of companies from the following industries: food and staples retailing; household products; food products; beverages; tobacco; and personal products; and for the energy sector, VDE, Vanguard Energy Index Fund (I generally like anything from Vanguard), the 3 month return is 7% and a 10% one month return.

Stock Pick/Advice 10-15-2017

This week Bank of America beat earnings and advanced close to 52 week highs at $25.83. However, at that price, it is only pennies above its book price (stockholder equity/shares outstanding) of $25.17. In addition, it pays a 1.85% dividend and the average of 32 marketwatch analysts give it a rating of overweight with over half giving it a buy rating. We are in a rising interest rate atmosphere which is a benefit to banks (suggesting an inelastic demand for money if you remember your principles of microeconomics). The bank has been out of favor with investors since the financial crisis, however, it is gaining momentum as metrics and insight replace emotions. The bank is also in the midst of a $12 billion stock buy back program which will increase both its book value and earnings/share which could result in a higher dividend payment. I give this stock a 1 year price target of $32-$35.

(full disclosure, I do own shares of BAC)

(full disclosure, I do own shares of BAC)

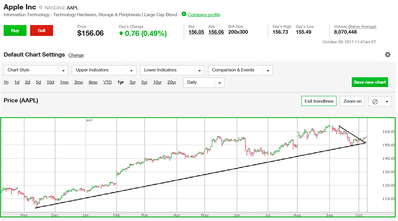

Stock Pick/Advice 10-8-2017

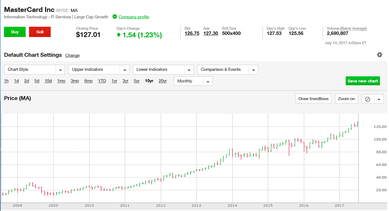

APPLE 1 YEAR CHART

APPLE 1 YEAR CHART

A study that just came out on how people are watching TV predicted that by 2020, all television programs will be watched on some type of mobile device. As a result, Bank of America re-iterated its buy recommendation on Apple. I couldn't agree more. In addition, if the Trump tax plan is passed, lowering the corporate tax rate, we will probably see a repatriation of the over $200 billion dollars that Apple has in cash in foreign accounts (legally). The Trump tax plan calls for a corporate tax rate reduction to 20 percent from 35 percent and a lower repatriation tax rate for U.S. companies' accumulated foreign earnings. It's almost certain, that this cash, in part, will be used to buy back stock and increase dividends.

"We look at two aspects of potential tax law reform and their implications on Apple. … We conclude that: existing deferred tax liability on the balance sheet could allow for substantially all of Apple's foreign cash to be repatriated to the U.S.," analyst Wamsi Mohan wrote in a note to clients Monday (CNBC). Mohan reaffirmed his $180 price target for Apple shares, representing 16 percent upside to Friday's close.

"We look at two aspects of potential tax law reform and their implications on Apple. … We conclude that: existing deferred tax liability on the balance sheet could allow for substantially all of Apple's foreign cash to be repatriated to the U.S.," analyst Wamsi Mohan wrote in a note to clients Monday (CNBC). Mohan reaffirmed his $180 price target for Apple shares, representing 16 percent upside to Friday's close.

Stock Pick/Advice 9-24-2017

Apple is down over 8% from its highs as a result of lower earnings and sales estimates and at some point, it's going to be a buying opportunity, however, based on technical analysis, I think it has a way to go, quite possibly to $142, and at that point, I will evaluate and consider becoming a buyer. In the meantime, I'll stay on the sidelines and evaluate analysts comments. However, it remains one of the stocks with an unbelievably low short interest, less than 1%, so many investors are buying and holding. Also, from Benzinga's web site, "Apple has a good reputation of being able to convince smartphone users to migrate from lower priced phones to higher priced models, Mohan argued. Specifically, between 2014 and 2016, more consumers bought phones within a higher price brand. Moreover, sales of iPhone devices in the $400 to $499 range declined between 2014 and 2016, but sales of iPhone devices in the $500 to $599 range actually increased."

Stock Pick/Advice 9-17-2017

Unless you've been living under a rock, you've heard at the massive data breach at Equifax that has compromised the information of 143 million people. As a result the stock has dropped from $145/share to $92 share. I have been receiving a number of inquiries if it's time to jump in a buy. My feeling is a resounding no. I think the stock has a longer way to drop, particularly if its CEO goes before Congress (which he will) and does not have a good showing. If you look at the attached long term chart of EFX, it's next support level is in the vicinity of 25-48, so I'm still on the sidelines.

I think what is a good buy, particularly in the light of hurricanes Harvey and Irma, is Home Depot. Since the hurricanes it is up 6.5%, but with 25% of the homes totally lost in the Florida keys, and the wide spread devastation along the Gulf coast and both coasts of Florida, I see this stock running well for the next year.

I think what is a good buy, particularly in the light of hurricanes Harvey and Irma, is Home Depot. Since the hurricanes it is up 6.5%, but with 25% of the homes totally lost in the Florida keys, and the wide spread devastation along the Gulf coast and both coasts of Florida, I see this stock running well for the next year.

Stock Pick/Advice 9-10-2017

After taking the month of August off, we're back with the stock picks. This week I'm recommending two stocks that I have in the past. Both of these companies have good technical and outlooks from MarketWatch.

OPK was first recommended by me when it was around $10, it went to $19, and had some disappointments. The biggest was it's soon to be blockbuster drug Rayaldee. It's approval by the FDA was delayed by 6 months because of concerns over a vendors quality control, it was slow off the mark, and is now gaining momentum. In addition, it has an excellent pipeline of drugs in Phases 1-3. There are 5 analysts who follow this stock on Marketwatch and they have an average recommendation of buy with a price target of $14.50. The chart looks good since it just broke a long term resistance line in addition to breaking its 50 day moving average to the upside. I still believe this is a great "buyout" target for a larger biotech such as Pfizer. My reason for this is the fact that the CEO, Robert Frost, owns over 1/3 of the shares outstanding and the only way to get full value would be to sell the company. In addition, 21% of the shares outstanding are owned by institutions and there is a 20% short interest. Once this stock begins to move, there are only half the shares outstanding available to the market, there is consolidation of the stock (see chart) and it will be compounded by a stock squeeze.

HCLP, is a master Ltd. partnership that I first recommended in its teens. It supplies sand to owners of fracking wells. It went as high as $68 and is now trading at $8. It suspended its dividend payments 2 years ago (the stock price went down as the price of oil receded), and has announced earlier this year that it will resume these dividend payments later this year. Oil has just reached its highest price in the past month as a result of geopolitical strife, continued OPEC production cuts and a number of oil rigs in the Gulf being shut down because of Hurricane Harvey. Eleven analysts follow this on MarketWatch with an average rating of a buy and a one year price target of $15.5.

OPK was first recommended by me when it was around $10, it went to $19, and had some disappointments. The biggest was it's soon to be blockbuster drug Rayaldee. It's approval by the FDA was delayed by 6 months because of concerns over a vendors quality control, it was slow off the mark, and is now gaining momentum. In addition, it has an excellent pipeline of drugs in Phases 1-3. There are 5 analysts who follow this stock on Marketwatch and they have an average recommendation of buy with a price target of $14.50. The chart looks good since it just broke a long term resistance line in addition to breaking its 50 day moving average to the upside. I still believe this is a great "buyout" target for a larger biotech such as Pfizer. My reason for this is the fact that the CEO, Robert Frost, owns over 1/3 of the shares outstanding and the only way to get full value would be to sell the company. In addition, 21% of the shares outstanding are owned by institutions and there is a 20% short interest. Once this stock begins to move, there are only half the shares outstanding available to the market, there is consolidation of the stock (see chart) and it will be compounded by a stock squeeze.

HCLP, is a master Ltd. partnership that I first recommended in its teens. It supplies sand to owners of fracking wells. It went as high as $68 and is now trading at $8. It suspended its dividend payments 2 years ago (the stock price went down as the price of oil receded), and has announced earlier this year that it will resume these dividend payments later this year. Oil has just reached its highest price in the past month as a result of geopolitical strife, continued OPEC production cuts and a number of oil rigs in the Gulf being shut down because of Hurricane Harvey. Eleven analysts follow this on MarketWatch with an average rating of a buy and a one year price target of $15.5.

Stock Pick/Advice 7-30-2017

This week is a 2-for. Both Altria (MO) and Amazon stock was pummlled this week but they both represent a buying opportunity. Altrai's stock was down nearly 10%(-$7.02). The reason was a statement by the FDA that it's proposing to cut the level of nicotine in cigarettes to non-addicting levels. One analysts stated the following

"We've longed believed the FDA would ultimately take a more comprehensive approach toward regulating nicotine as a natural next step," Wells Fargo analyst Bonnie Herzog said in a note to clients.

"Overall, while the market is viewing today's announcement as a 'negative' for cigarette manufacturers, we believe this could prove to be an opportunity over the long term for reduced risk products and, therefore, a positive for Altria/PM as they have a unique competitive advantage."

I couldn't agree more and I plan on adding this to my holdings. I envision another down day and then a recovery. What else makes this stock attractive is a near 3.65% dividend.

Amazon was down 26 points (2.5%), on an earnings miss but it exceeded sales. Earnings were down 77% from a year earlier while revenue increased by 25%. Why the revenue increase and the drop in profits? The reason is simple, costs. Amazon is undergoing a huge investment in capital equipment to increase efficiency, hence the lower profits. Analyst Michael Olson of PiperJaffray sees Amazon's increased costs "as Amazon investing into strength, not a sign of weakness for Amazon's long-term margin." Investments in Fulfillment By Amazon capabilities will allow the company to host and handle more third-party products, increasing selection and appeal to customers and Jefferies analyst Brian Fitzgerald raised his price target on Amazon's shares from $1,150 to $1,250 and maintained his Buy rating. He argues that Amazon will only grow faster as more people buy goods online. Amazon's "ability to get purchases to consumers fast is a huge differentiator" and as e-commerce grows from the current 10% of consumer spending to 20% and 30% and beyond, Fitzgerald predicts that Amazon will scoop up more of that growth than its competitors. (Barrons)

"We've longed believed the FDA would ultimately take a more comprehensive approach toward regulating nicotine as a natural next step," Wells Fargo analyst Bonnie Herzog said in a note to clients.

"Overall, while the market is viewing today's announcement as a 'negative' for cigarette manufacturers, we believe this could prove to be an opportunity over the long term for reduced risk products and, therefore, a positive for Altria/PM as they have a unique competitive advantage."

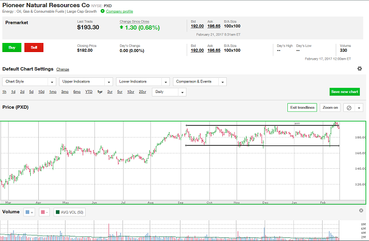

I couldn't agree more and I plan on adding this to my holdings. I envision another down day and then a recovery. What else makes this stock attractive is a near 3.65% dividend.