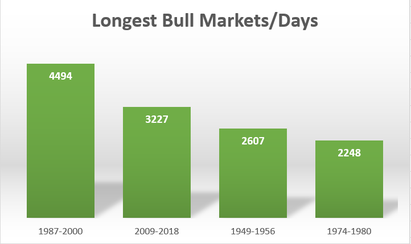

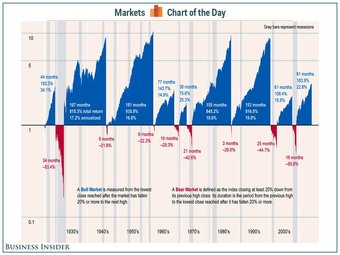

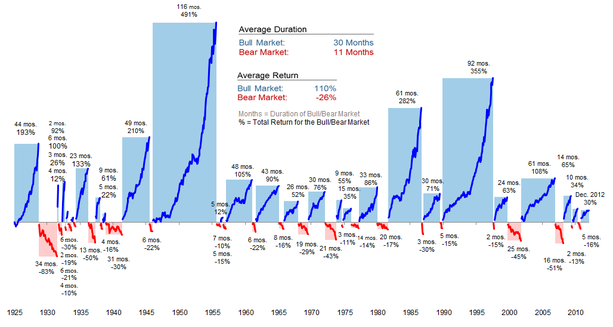

So, you ask, how long will this bull market last? Good luck on predicting that, but as long there is no unforeseeable shock (such as a big bomb going off somewhere), I don’t see any end to this in the next 3-6 months. The corporate tax cut increases corporate profits by over 20%, and the reduction in regulation that Trump has accomplished by Executive Order, including the construction of the Keystone pipeline, has also saved corporate dollars. So with the Dow rising 25% last year, it’s indicative of a fairly efficient market. If I should see and storm clouds on the horizon, you’ll be the 1st to know.

RSS Feed

RSS Feed