Looking back, the exodus and downfall of the city began in the 1960s when a building boom pushed people into the suburbs. If I correctly remember my college sociology, it was a zone of transition; one ethnic group (whites) moved out and another (black Americans) moved in.

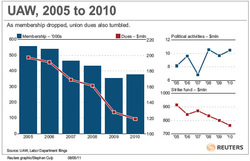

Liberal benefits to workers and a product that was declining in quality further contributed to the downfall of GM and Detroit. During the 2008 financial crisis, the average union auto worker was being paid $74 per hour with benefits (CNBC), $31 without. By comparison, the average Toyota worker was being paid $47 per hour with benefits. In Detroit, for every $1 of pay, $1.08 was paid in benefits. Compounding the problem was the largess of government. Prior to bankruptcy, there were 18 city workers per 1,000 residents compared to a national average in big cities of five to 10 per 1,000 workers.

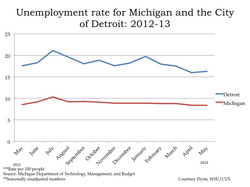

Demographics also played a role.

- The high school education rate is 77 percent compared to a national average of 88 percent.

- The four-year college graduation rate is 13 percent compared to more than 30 percent nationwide.

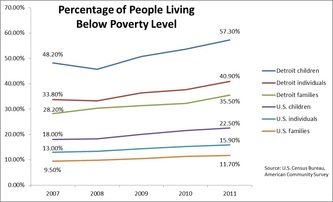

- Approximately 40 percent of the households are below the poverty level (15-16 percent nationwide)

- Detroit is breeding poverty. Close to half the children are being born to single mothers and the child poverty rate is close to 60 percent.

In addition, Detroit had a 3.5% income tax, that residents had to pay in addition to both Federal and state income tax. It is no wonder that there was a huge migration out of the city

It doesn’t take a CFO to recognize that these numbers are unacceptable, and a major catalyst in a dwindling tax base and a lack of city revenues. At $18 billion in debt (of which $11 billion are pension-related liabilities), Detroit is the largest American municipality to declare bankruptcy. Formerly it was Jefferson County in Alabama at $4 billion.

Last fall, President Obama stated, “We refused to throw in the towel and do nothing. We refused to let Detroit go bankrupt. We bet on American workers, and American ingenuity, and three years later, that bet is paying off in a big way.”

Oops.

Looking at increased welfare bases and similar situations in many other cities and states across America, I suspect there are more bankruptcies to follow.

Are you listening, California?

RSS Feed

RSS Feed