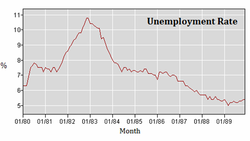

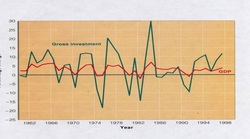

First and foremost, this was not the worst recession since the depression. It had the potential to be the worst, but it was averted by the actions of Ben Bernanke’s FED and the bipartisan passage of TARP (Troubled Asset Relief Program). The only superlative that 2008 recession can claim is that it was the longest, 16 months, from December 2007, to June 2009. The National Bureau of Economic Research (NBER) is the organization that is responsible for telling us when we enter and exit a recession. The worst recession was the double dip recession of the early 80’s, particularly where we had an unemployment rate above 10% for 8 months (with a high of 10.8%) and inflation at a high of 11%. This gave us a misery index (inflation plus unemployment) of over 21%. By contrast, in the most recent recession, unemployment was above 10% for only 1 month (10.2%) and we actually had deflation for a year of slightly over 2% (which took some of the bite out of the recession). Deflation is where prices actually go down as a result of a lack of aggregate demand (a poor economy). The last time we had deflation was briefly in 1950 and then before that, the depression where prices went down over 18% from 1929-1939.

During both recessions, the administration sought and got a fiscal stimulus program. However, these programs and results were vastly different; first, Ronald Regan’s Economic Recovery Tax Act.

First and foremost, I was in favor of a stimulus but not this Act. I will argue (and the numbers will corroborate) that this wasn’t a stimulus, but a liberal democratic agenda in stimulus clothing. Here are some of the provisions: a $7500 tax credit if you purchase a “plug in” electric car, the problem being they weren’t available until 2010, $50 billion towards clean energy such as hybrid cars and weatherizing homes, $11 billion to update the nation’s electric grid, an increase in the amount of unemployment benefits and food stamp in addition to increasing the length of unemployment benefits to 99 weeks. The unemployment benefits we covered in a previous blog which we stated contributed to an unemployment rate above 8% for more than 40 months and a long term unemployment rate of 40% of those unemployed.

This month’s blog will look at Cash for Clunkers. This program offered $3500-$4500 to people who traded in an old car for a new one with higher fuel economy. The old car was then destroyed by pouring acid in the engine and crushing the car. The intent was to increase vehicle sales, prop up the faltering American auto industry and make the nation's car and truck fleet marginally more efficient. As a result, 690,000 cars were purchased under the cash for clunkers program. At first blush, it may appear as a success. However according to Edmunds.com and CNN, the program was anything but a success and left the nation in worse shape. How you ask. Of the 690,000 cars purchased, it was estimated, via sampling, that only 125,000 of the sales were incremental, i.e., 565,000 would have been sold regardless of the program. This came at a taxpayer cost of $24,000/vehicle. What was even more disconcerting, was as a result of the 690,000 cars that were crushed, and hence, taken off the used car market, the cost of a used car increased by 16.5% 2 years after the program.

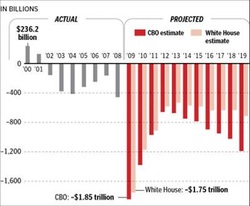

As an afterthought, many people (myself included) have difficulty trying to comprehend the magnitude of the figure 1 trillion. To put it in perspective; a million seconds is 10 days, a billion seconds is 31.5 years, and a trillion sends is 32,000 years; and the Obama administration has run this deficit every year of his presidency. This is the same Obama who as a Senator stated “raising the debt limit is “a sign that the U.S. government can't pay its own bills.”

RSS Feed

RSS Feed