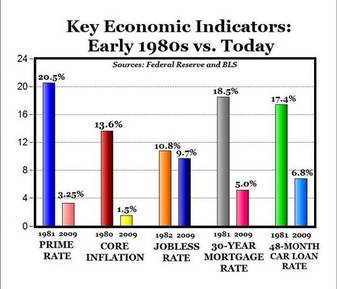

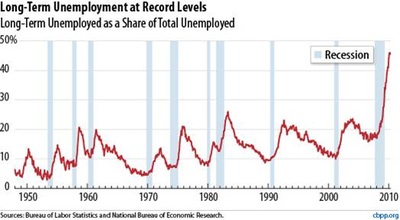

By contrast the 2007-09 recession had no inflation, because the recession was caused by a deficiency in aggregate demand and unemployment was above 10% for only 1 month peaking at 10.2%.

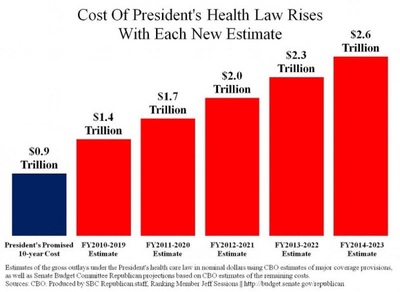

Also as a result of Obamacare, taxes have increased, both Medicare and a tax on all medical devices.

Capital gains taxes have increased by nearly 50% which stymies investment, and the marginal tax rate has increased to 39.6% from 35%.

Dodd-Frank has imposed over an additional 300 rules and regulations on banks and the shadow banking industry.

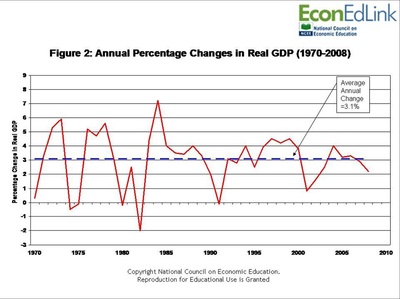

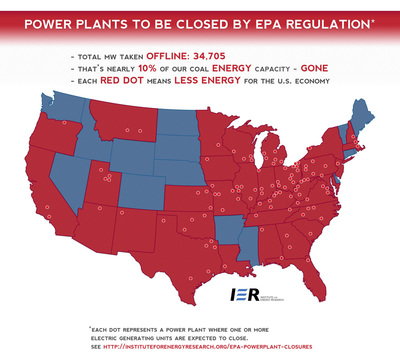

As a result of excessive regulation, we have seen the strangulation of business investment because of uncertainty and costs. We are currently in earnings season and what I find to be particularly disconcerting, is that while many businesses are beating earnings, they are falling short of revenue expectations. What this is telling me is that while businesses are getting lean, sales are not there and they are decreasing. At some point, business will not be able to cut any further and the bottom line will suffer.

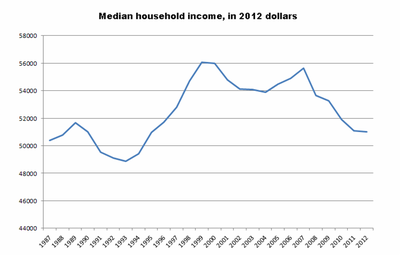

Given the aforementioned, I believe that we are in for a recession or continued stagnant growth just above 0. A number of leading and coincidental indicators are down; durable goods orders (i.e., business investment), the stock market (which causes a negative wealth effect), consumer expectations, lack of inflation, stagnant wages, and the average work week.

What is needed is an administration that doesn’t want to run you life, but an administration that can provide a favorable environment for business where

RSS Feed

RSS Feed