In February, 2003, the SARS (Severe Acute Respiratory Syndrome) was identified that affected more than 25 countries (info from WHO). Since then, a small number of cases have occurred as a result of laboratory accidents or, possibly, through animal-to-human transmission (Guangdong, China). There were over 8000 cases reported with a mortality rate of 10%; if you were 65 or over, it was a 50% mortality rate. During that period the Dow dropped about 200 points or 2.5%.

Next came the bird flu, aka Avian Influenza, in 2005. Total cases were difficult to confirm, however, according to the NY Times, it exceeded 60%. That’s correct, 60%. What did the market do? It yawned and traded sideways for 10 months with the Dow trading slightly higher than 10,000.

According to the CDC, there have been 32,000,000 cases of the seasonal flu with 18,000 deaths attributed to the flu with a mortality rate of less than .1%.

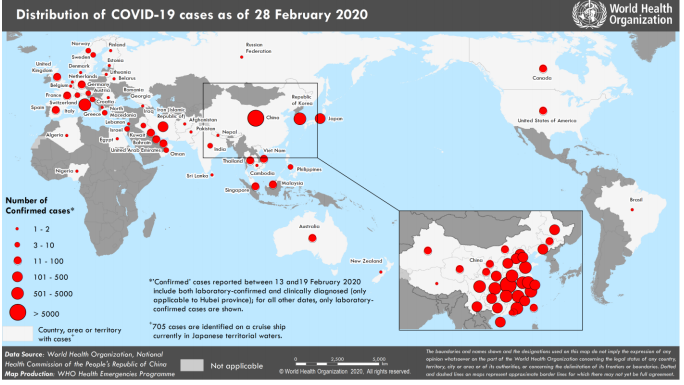

Enter the Coronavirus. According to the WHO, there over 85,000 cases in 46 countries; with over 60 cases in the US. There have been 2,963 deaths with none in the US (info from CNN). That puts the mortality rate at 3.5%, significantly lower than SARS or the Avian flu.

Now, getting back to the question of what you should do with your retirement account, do nothing. The Dow Jones has dropped over 14% which puts it into correction territory. A correction occurs when the market drops more than 10% and if it should drop 20%, it becomes a bear market. Since WW2, there have been 26 market corrections and on the average, a market recovers from a correction within 3-4 months (info from CNBC). Ask yourself a question. What’s your most valuable asset? For most of you, it’s your house. Do you go out and have your home appraised every month? Of course not, therefore, stop checking your retirement account daily. Do nothing but do it well.

One last tidbit. This is a huge buying opportunity and the stocks I like are the companies that are blue chip and have been hit the hardest such as: Apple, Exon Mobile, Intel Microsoft, and Royal Dutch Shell.

RSS Feed

RSS Feed