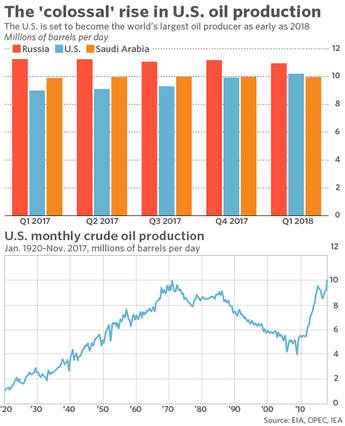

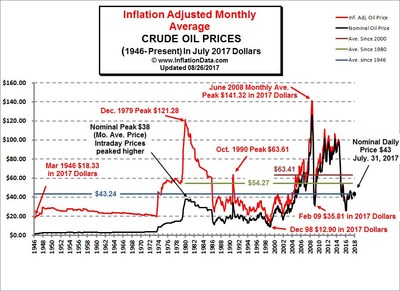

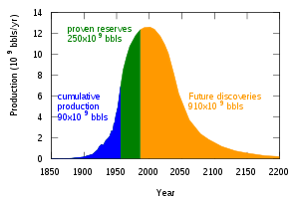

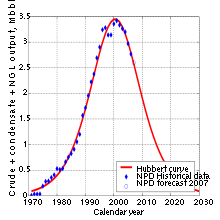

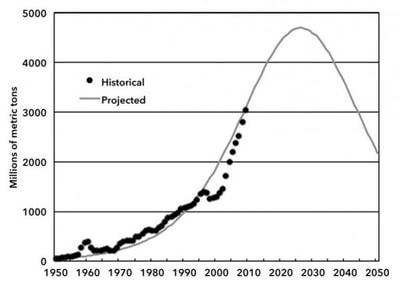

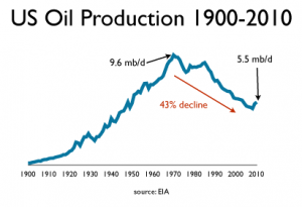

More background on oil and production. In the 1956, Marion Hubbert, an American Geologist came forth with a theory concerning a countries oil production hence known as Hubbert’s Peak. Hubbert stated that fossil fuel production for a country would follow that of a normal bell shaped curve. It will increase at an increasing, then increase at a decreasing rate, reach a peak and then decrease. The ultimate conclusion is that we (the world) will ultimately deplete fossil fuel and al alternate source is needed. If you look at the charts below for Norway, China and the US, it follow the theory perfectly. However, along comes fracking technology and within 10 years, we have doubled the production of US oil. Production is expected to increase, particularly as oil remains above $60, and we are expected to surpass Russia as the number 1 producer of oil in the world. The EIA (Energy Information Agency) has stated that we have proven oil reserves of over 35 billion barrels and from the US Geological association, over a trillion barrels of remaining reserves and the EIA is lower at 200 billion.

Given the above, I see continuing cheap oil in the foreseeable future.

RSS Feed

RSS Feed