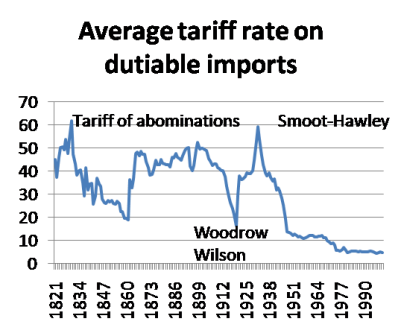

Tariffs were the principal source of the US government’s income (sometimes as much as 90%) prior to the imposition of an income tax in 1917. There have been many positions on tariffs. Abe Lincoln stated that he didn’t know much about trade but knew that if an American bought a coat from an English coat maker, the American had the coat and the Englishman had the money. However, if an American bought a coat from another American, the American had the coat and the other American had the money. It seems fairly intuitive at first, however, what Lincoln did not take into account was the economic concept of comparative advantage. Essentially, this is when a country can produce a good with the lowest opportunity cost. To keep it simple with an example, it means that New England States are better off growing apple and potatoes and trading with Florida for oranges and bananas. Likewise, China has cheap labor and insufficient natural resources for its 1.3 billion population, whereas the US has technology and resources, hence trade with China, and given its inexpensive cost to produce many goods, electronics clothes etc, the huge trade imbalance (see chart).

In retrospect, while there is short term pain (higher prices to consumers and lower profits for businesses), in the long run, the prospects are favorable. Even tho I voted for Trump (which was more of a vote against Hillary), I don’t defend him, but he had the intestinal fortitude to tackle trade deficits and in the long run, this will be a net positive for the US.

RSS Feed

RSS Feed