First, the 401K. It’s so named because of the section of the tax code that sets forth the criteria. It’s probably the most popular plan and I advise my students to try and find a job that offers it as a benefit. The plan is sponsored by an employer and involves pre-tax income that allows you to contribute to the plan which your employer matches to some extent. The money you contribute is generally a percentage. For instance: if you make $1000/week, you may elect to take out 10% in which case you are taxed on only the remaining $900. Your employer, especially private sector will contribute usually, anywhere from 2-5%. Rarely have I seen it higher than that amount. However, your maximum contribution is limited to $18,000/year, and there is a combined contribution limit of $53,000 for the employer and employee.

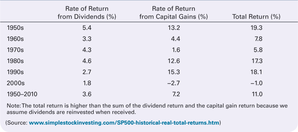

You then get to pick the type of investments you want that range anywhere from very conservative to aggressive. The younger you are the more aggressive (growth stocks) you should be. Keep in mind, the average return for the S&P 500 from 1950-2010 has been 11% which far eclipses any bond fund. To oversee your account, your employer usually hires an administrator such as Fidelity Investments. You can increase or decrease your contributions at any time and you should elect a beneficiary (If you’re married, your spouse is automatically the beneficiary.)

These exceptions are hardship withdrawals. A hardship withdrawal is “made on account of an immediate and heavy financial need of the employee,” according to the IRS. A letter must be written to IRS outlining the hardship/need. Some examples are: medical payments, college tuition, down payment on a primary residence, or to prevent foreclosure of a residence.

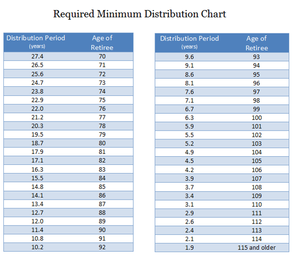

Lastly, at age 70 ½, there is a mandatory withdrawal (attached chart). To compute the mandatory withdrawal, divide the balance in your 401K by the distribution period in years next in column 1. For Instance fi you are age 70 and have $500,000 in your 401K, your mandatory withdrawal would be $500,000/27.4 or $18,248.18; and yes, if you start saving early you can easily have 6-7 figures by the time you retire.

RSS Feed

RSS Feed