|

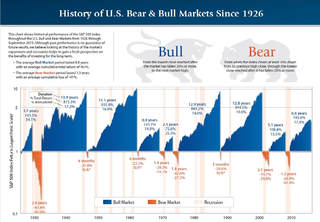

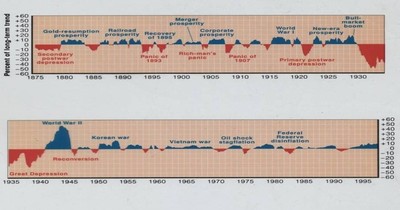

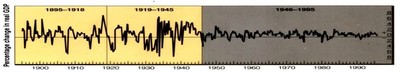

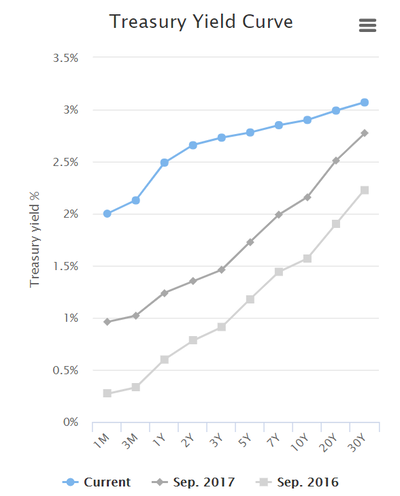

If you look at any principles of macroeconomics book, it will define a recession as two consecutive quarters of negative GDP. However that is not entirely true. The organization that tells us when a recession starts and ends is NBER, the national Bureau of Economic Research. This is an independent think tank that was formed in the early 1920’s in Cambridge, MA. From there website: NBER is the nation's leading nonprofit economic research organization. Twenty-seven Nobel Prize winners in Economics and thirteen past chairs of the President's Council of Economic Advisers have held NBER affiliations. At one point, former FED chairman Ben Bernanke was the Director of NBER.  NBER defines a recession as A significant decline in activity, spread across the economy, lasting more than a few months, visible in industrial production, employment, real income and wholesale-retail sales; NBER. The downturn must be Prolonged, Protracted and Pervasive. As a result, NBER usually doesn’t know that we are in a recession until 6-9 months after it started, and doesn’t tell us when it ends until 6-9 months. For example, the most recent recession began in December of 2007, but it wasn’t stated by NBER until fall of 2008. Looking at the accompanying charts, we can see recessions and expansions in the economy. Most notable, in the later half of the 20th century, these fluctuations have become less variable, and the period of expansion (growth without a recession) longer. Why is this? The answer is relatively simple, we have gotten better at economics. To date, the longest expansion in the US was in the 1990’s and it lasted 111 months. The most recent recession was not the worst since the great depression (that would be the double dip recession of the early 1980’s), but it was the longest at 18 months and ended in June of 2009. We are currently approaching a new record for a period of expansion. In addition, we are in the longest bull market in history (since March of 2009). This now begets the question, when is the next recession. The short answer is that I don’t see one in the short term (3-6 months) unless there is some major shock to the economy such as a 9/11 scenario. What’s interesting is that every republican president since Teddy Roosevelt has experienced a recession during their 1st term. The reasons for this are varied, but it is not because of Republican policies. The stock market is generally a leading economic indicator, and since Trump was elected, it has gone from 18,000 to nearly 27,000, a nearly unprecedented increase (chart). Unless there is a total breakdown in trade talks, (see last month’s blog), I see the expansion continuing. In addition, every recession has been accompanied by an inverted yield curve, and it is not close (chart). A student of mine once asked me, “ In one word, what is the best way to describe the cause of a recession?”. I thought about for about a day and came back with the answer of Greed, and contrary to Gordon Gekko from the movie Wall Street, greed is not good. If you look at the double dip recession of the 1980’s, it was high commodity prices coupled with high interest rates and the bubble burst. The recession of the late 80’s was the savings and loan crisis and that bubble burst, the 1991 recession was the housing market bubble bursting, the 2001 recession was an inflated stock market and the dot com bubble burst and finally the most recent recession was a HIGHLY inflated housing market in which the bubble didn’t burst, it exploded, and if it wasn’t for the actions of Ben Bernanke, we could have quite possibly seen a 2nd depression. As of now, I see no storm clouds on the horizon and no bubbles. I expect the economy and stock market to keep chugging, especially, if trade agreements are reached by the November elections.

0 Comments

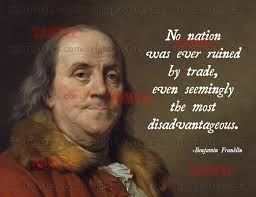

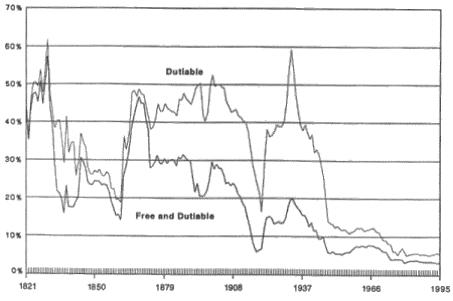

Abraham Lincoln once said, “I don’t know much about trade, but what I do know is that if an American buys a coat from an Englishman, the American has the coat and the Englishman has the money, but if an American buys a coat from an American, the American has the coat and another American has the money”. At first, it sounds logical, but he failed to take into account 2 important concepts, opportunity cost and comparative advantage. Opportunity cost is the value of the best alternative use of a resource. For instance, if you go to college, your opportunity cost is the money you forego from working full time. If you’re a farmer and you grow corn, the opportunity cost is what you’re not growing, such as potatoes. Comparative advantage occurs when a country is able to produce a good at the lowest opportunity cost. For instance, why don’t we grow bananas in New England? Well, if we did, we would get very small bananas and if we’re growing bananas, we can’t grow a crop that is cheaper to produce and would garner us more revenue, such as corn, apples or potatoes. Hence, we trade our apples for Jamaican bananas. Hence, Ben Franklin’s quote comes to mind, “no nation was ever ruined by trade”.  Another quote that comes to mind is “if you don’t learn from history, you are doomed to repeat it.” During the great depression GDP was plummeting. In order to spur the economy, Congress, passed amongst the highest tariffs in history, specifically the Smoot-Hawley tariff. The logic being Americans will buy from other Americans instead of international goods. What Congress didn’t realize was the unintended consequence. At that time, the balance of trade in the US was positive, in other words, we exported more goods than we imported. As a result of the tariffs the US imposed, other countries reciprocated and world trade plunged by 2/3 ‘s making a bad situation for the economy worse. It took 4 years, but the tariffs were eventually removed.  Fast forward to now. President Trump has imposed the largest tariffs since the depression and other countries have reciprocated, and yes, we are in a trade war with China. Plan on seeing world trade falling as well as GDP (Gross Domestic Product, how we measure growth). I think the tariffs are a terribly bad idea, HOWEVER, we have just re-negotiated a trade deal with Mexico that puts us in a better position than we were with NAFTA (North Atlantic Free Trade Agreement), and that most likely will occur with Canada (our largest trading partner) also. In addition, it will be a matter of time before we re-negotiate deals with China and the European Union, AND if we end up in a better trading position, it would appear that Trump would be crazy like a fox.  A note on the European Union: The EU was formed in 1958 and was based on a famous US document; the US Constitution. There is an article in the Constitution that states that one state can't tax the goods and services of another state. In 1957 (treaty of Rome), initial members of the EU realized that free trade is good and adopted that verbiage. There are currently 28 members in the EU, up from its initial membership of 15 and in addition to free trade, there is also free passage from one country to the next. The EU should not be confused with the Eurozone. There are 19 countries in the Eurozone (which are also EU members) that have adopted the Eurocurrency. |

AuthorJohn Tommasi is a retired Senior Lecturer of Economics & Finance from Bentley University and the University of New Hampshire. Archives

February 2023

Categories |

RSS Feed

RSS Feed