|

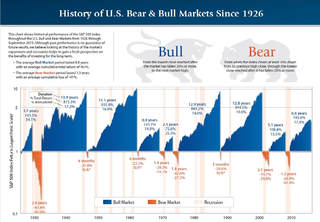

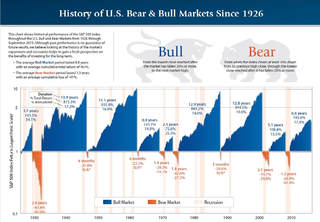

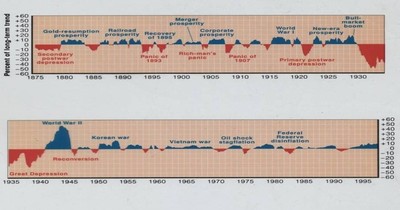

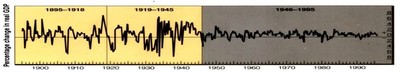

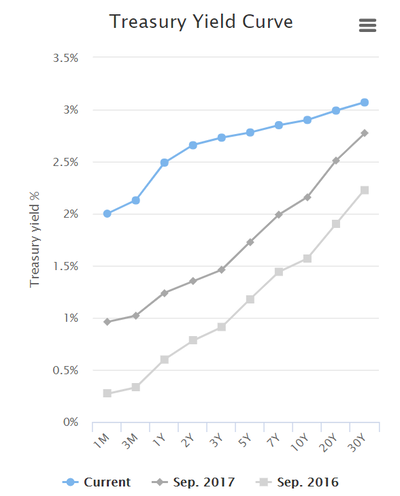

If you look at any principles of macroeconomics book, it will define a recession as two consecutive quarters of negative GDP. However that is not entirely true. The organization that tells us when a recession starts and ends is NBER, the national Bureau of Economic Research. This is an independent think tank that was formed in the early 1920’s in Cambridge, MA. From there website: NBER is the nation's leading nonprofit economic research organization. Twenty-seven Nobel Prize winners in Economics and thirteen past chairs of the President's Council of Economic Advisers have held NBER affiliations. At one point, former FED chairman Ben Bernanke was the Director of NBER.  NBER defines a recession as A significant decline in activity, spread across the economy, lasting more than a few months, visible in industrial production, employment, real income and wholesale-retail sales; NBER. The downturn must be Prolonged, Protracted and Pervasive. As a result, NBER usually doesn’t know that we are in a recession until 6-9 months after it started, and doesn’t tell us when it ends until 6-9 months. For example, the most recent recession began in December of 2007, but it wasn’t stated by NBER until fall of 2008. Looking at the accompanying charts, we can see recessions and expansions in the economy. Most notable, in the later half of the 20th century, these fluctuations have become less variable, and the period of expansion (growth without a recession) longer. Why is this? The answer is relatively simple, we have gotten better at economics. To date, the longest expansion in the US was in the 1990’s and it lasted 111 months. The most recent recession was not the worst since the great depression (that would be the double dip recession of the early 1980’s), but it was the longest at 18 months and ended in June of 2009. We are currently approaching a new record for a period of expansion. In addition, we are in the longest bull market in history (since March of 2009). This now begets the question, when is the next recession. The short answer is that I don’t see one in the short term (3-6 months) unless there is some major shock to the economy such as a 9/11 scenario. What’s interesting is that every republican president since Teddy Roosevelt has experienced a recession during their 1st term. The reasons for this are varied, but it is not because of Republican policies. The stock market is generally a leading economic indicator, and since Trump was elected, it has gone from 18,000 to nearly 27,000, a nearly unprecedented increase (chart). Unless there is a total breakdown in trade talks, (see last month’s blog), I see the expansion continuing. In addition, every recession has been accompanied by an inverted yield curve, and it is not close (chart). A student of mine once asked me, “ In one word, what is the best way to describe the cause of a recession?”. I thought about for about a day and came back with the answer of Greed, and contrary to Gordon Gekko from the movie Wall Street, greed is not good. If you look at the double dip recession of the 1980’s, it was high commodity prices coupled with high interest rates and the bubble burst. The recession of the late 80’s was the savings and loan crisis and that bubble burst, the 1991 recession was the housing market bubble bursting, the 2001 recession was an inflated stock market and the dot com bubble burst and finally the most recent recession was a HIGHLY inflated housing market in which the bubble didn’t burst, it exploded, and if it wasn’t for the actions of Ben Bernanke, we could have quite possibly seen a 2nd depression. As of now, I see no storm clouds on the horizon and no bubbles. I expect the economy and stock market to keep chugging, especially, if trade agreements are reached by the November elections.

0 Comments

Leave a Reply. |

AuthorJohn Tommasi is a retired Senior Lecturer of Economics & Finance from Bentley University and the University of New Hampshire. Archives

February 2023

Categories |

RSS Feed

RSS Feed