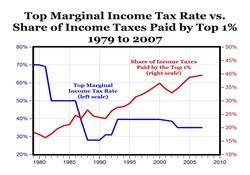

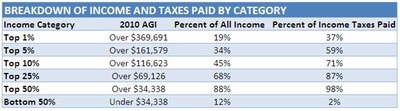

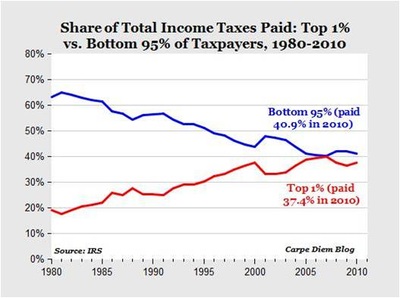

But that’s not all, if you look at the chart below right, you will see in 2007, that the top 1% paid more income taxes than the bottom 95% of the population. Currently, as a result of the recession, the top 1% is paying more than the bottom 92%. If you look at the table,bottom left, from the National Taxpayers Union (their data is from the IRS), you will see that in 2010 (the year with the most recent data), the top 1% paid 37% of all the federal income taxes collected by the federal government and the bottom 50%, half the population, paid 2%.

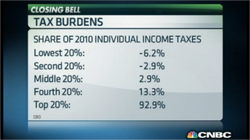

In a recent CNBC report, Jane Wells reported that the rich don’t pay most of the taxes, they pay all the taxes. What she included was the earned income credit that low income workers receive (they not only pay no taxes, they get tax dollars back from the government). If this is included, then the top 20% of income earners pay 92.9% of all federal income taxes the government collects. The numbers are from the Congressional Budget Office.

To see the video go to http://video.cnbc.com/gallery/?video=3000225936

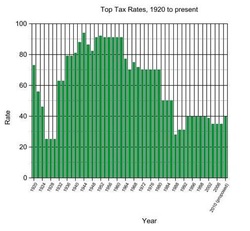

Let’s recap; the top 1% pays close to 40% of all income taxes received by the federal government (in 2007 it was 40.2%), they pay more in taxes than the bottom 92% of wage earners, and the top quintile of taxpayers pays literally all the taxes, and as the highest marginal tax rate decreased over the years, the rich paid more in taxes. That Congresswoman Shea-Porter, meets my definition of the rich paying their fair share of taxes.

Addendum: Nothing infuriates me more then when someone says to me that Clinton raised taxes in 1993, and as a result the economy of the 90’s flourished. Taxes had nothing to do with the 90’s. This decade was unlike any other decade of the century; technology, and hence the economy, flourished. In 1992, AOL had 200,000 members, by 1996, they had 40 million. Everyone was buying computers, cell phones and any other information technology they could get their hands on. Worker productivity skyrocketed and unit costs plummeted. By the end of the decade, there were 30,000 dot com businesses. That is what drove the economy of the 90’s.

RSS Feed

RSS Feed