To the economist, life is very simple, benefits and costs. If the benefit of purchasing a good or service is greater than the cost, a rational individual will make the transaction. Taking a simple example, that coffee you bought this morning at Dunkin Donuts that you paid $1.60; would you have paid $1.61? If the answer is yes, then the benefit exceeded the cost. Let’s now extend that example to work. Intrinsic benefit notwithstanding (the joy of work), the benefit you get from work is your hourly pay. What then is the cost? Simply put, foregone leisure. So the rational individual will work as long as the hourly wage is greater than the leisure time he/she is foregoing. If someone is willing to work for say $6/hour, the benefits he's getting outways the cost of foregone leisure. It also has the additional benefit of keeping prices low to the consumer.

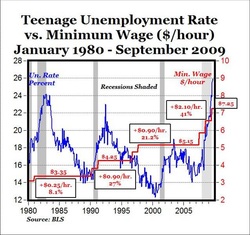

Let’s now look at businesses. The rational businessman is not in business to breakeven or incur a loss. He is in business to realize a profit, so he will hire a worker as long as the cost of hiring someone is less than the revenue they are producing. In other words, if it costs me to hire a worker at $7.25/hour, and that person makes $8.00 every hour for the business, I’ll hire him (obviously payroll taxes, workman’s comp etc. have not been considered to simplify the example). The minimum wage now increases to $9.00/hour. What happens to the workers who are producing less than that in revenue, they get laid off and unemployment increases; or if it is a small business that employs primarily minimum wage workers (think landscaping), the business goes out of business. But what else happens when the minimum wage increases, so to does prices, and the costs are passed on to the consumer. This is known as a wage price spiral or cost-push inflation. As a result, the effects of minimum wage have just the opposite effect of those intended by society’s “do-gooders”, an increase in unemployment amongst those it intends to help, the less skilled and uneducated, and no change in the poverty level, or quite possibly, a slight increase in poverty.

If President Obama gets his way and is allowed to increase the minimum wage, someone please explain to me how someone(particularly teenagers) is better off unemployed at $9.00/hour as opposed to being gainfully employed at $7.25/hour.

If I could change 3 laws to help the economy, I would eliminate the minimum wage law, discontinue extended unemployment benefits and do away with Obamacare known as the Affordable care Act(which will be anything but affordable), but that’s for another blog.

The expressed opinions of this blog are mine and mine alone and do not represent the opinions of Bentley University.

RSS Feed

RSS Feed