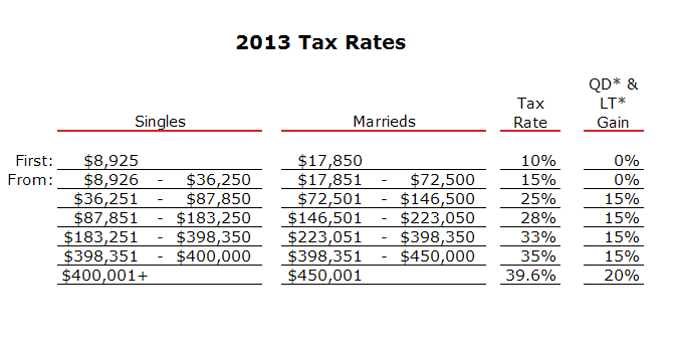

The attached chart is the old tax structure and the computations are as follows (the assumptions are that you don’t itemize deductions and you have 1 dependent child):

For $55,000 & married:

OLD RATE

The standard deduction is $13,000 and as a result, this is subtracted from your combined income and as a result, you are taxed on only $42,000 of income.

Tax Rate Tax paid Total Tax Liability

the 1st 17,850 is taxed at 10% 1,785

17,851-42,000 is taxed at 15% 3,622

Child tax credit -1000 4408

NEW RATE

The standard deduction is doubled to $24,000 and

as a result this couple is taxed on only $31,000 of

income.

Tax Rate Tax paid Total Tax Liability

the 1st $19,050 is taxed at 10% $1905

19051-42,000 is taxed at 12% 2754

Child tax credit is doubled -2000 $2659

This represents a decrease of 39.7%

For 150,000 & married:

OLD RATE

Tax Rate Tax paid Total Tax Liability

the 1st 17,850 is taxed at 10% 1,785

17,851-72,500 is taxed at 15% 8120

72,501-146,500 is taxed at 25% 18,500

146,501-150,000 is taxed at 28% 980

Child tax credit -1000 28,385

NEW RATE

the 1st 19,050 is taxed at 10% 1905

19,051-77,400 is taxed at 12% 7002

77,401-$150,000 is taxed at 22% 15972

Child tax credit -2000 22,879

This represents a decrease of 19.4%

For 750,000 and married

This becomes a little more difficult since many of the deductions the rich have are going to be decreased and this will hurt them (but not that much). As a result, I’m calculating the taxes on AGI, Adjusted Gross Income, i.e., income after deductions.

OLD RATE

Tax Rate Tax paid Total Tax Liability

the 1st 17,850 is taxed at 10% 1,785

17,851-72,500 is taxed at 15% 8,120

72,501-146,500 is taxed at 25% 18,500

146,501-223,050 is taxed at 28% 21,434

223,051-398,350 is taxed at 33% 57,849

398,351-450,000 is taxed at 35% 18,078

451,001-750,000 is taxed at 39.6% 118,800

Child tax credit -1000 244,566

NEW RATE

the 1st 19,050 is taxed at 10% 1,905

19,051-77,400 is taxed at 12% 7,002

77,401-165,000 is taxed at 22% 18,272

165,001-315,000 is taxed at 24% 36,000

315,001-400,000 is taxed at 32% 27,200

401,000-600,000 is taxed at 35% 70,000

601,000-750,000 is taxed at 37% 55,500

Child tax credit -2,000 213,879

This represents a decrease of 12.5%

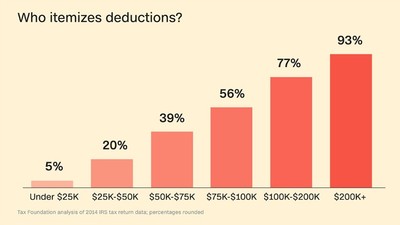

As you can see, there are tax savings across the board with the largest % tax breaks going to the lower income groups. It will also simplify the tax code by increasing the personal tax deductions. As a result, more households will file the short form (i.e., they will not itemize deductions) and this can represent savings from a tax preparer. As an economist, I feel simplifying the tax code and lowering the tax rate is an excellent step. However, it is projected to increase the deficit by $1.5 trillion dollars which given our existing debt, over $20 trillion, is a move in the wrong direction. This tax cut should also have been accompanied by spending cuts.

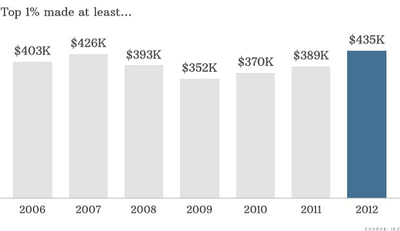

How much do you have to make to be in the top 1%? This differs by web site, but the IRS states that to be in the top 1% for 2014, you had to have AGI of at least $465,246. Also from the IRS, the top 1% paid 45% of all income taxes collected by the federal government in 2015.

RSS Feed

RSS Feed