The average cost of health insurance for a family plan is up to $19,600, with the average employee contribution at 30% at $5,800. In the past 10 years, inflation has been 51%, employee wage growth 68% and total premiums 239%.

While the vast majority of firms are small, most workers work for large firms that offer coverage. In 2018, 90% of workers are employed by a firm that offers health benefits to at least some of its workers. Even in firms that offer health benefits, some workers are not eligible to enroll (e.g., waiting periods or part-time or temporary work status) and others who are eligible choose not to enroll (e.g., they feel the coverage is too expensive or they are covered through another source). In firms that offer coverage, 79% of workers are eligible for the health benefits offered, and of those eligible, 76% take up the firm’s offer, resulting in 60% of workers in offering firms enrolling in coverage through their employer. All of these percentages are similar to 2017. Among all firms that offer health benefits, 13% provide additional compensation or benefits to employees if they enroll in a spouse’s plan, and 16% provide additional compensation or benefits to employees if they do not participate in the firm’s health benefits (Kaiser Foundation).

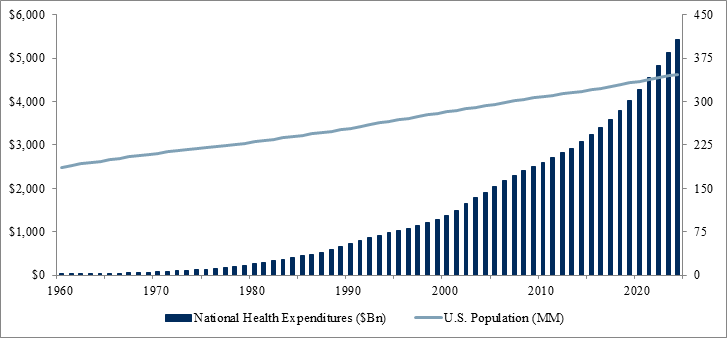

Health care costs, since the 60’s, have been increasing at paces at least 4 times that of inflation. The spike in the 60’s was a result of the implementation of both Medicare and Medicaid. That increased with the implementation of the Affordable Care Act.

RSS Feed

RSS Feed