The survey found that, of the respondents polled:

–36% can’t save for retirement

–32% can’t go on vacation

–28% can’t be financially independent

–21% can’t own their own home

–17% can’t pursue a job they’re passionate about nearly 10 percent of those polled carry more than $50,000 in student loan debt, and 37% more than $15,000.

-25% are working in a job that doesn’t require a degree

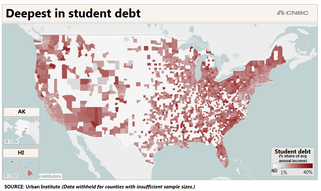

That is not surprising when you consider the total amount of student loan debt in America is in excess of $1.5 trillion and impacts nearly 45 million people.

If they could do it all over again:

–1 in 4 graduates said they would choose a different major

–19% wish they had studied harder

As for whether college was worth the debt accrued, 58% of adults said yes

As for whether college was worth the debt accrued, 58% of adults said yes

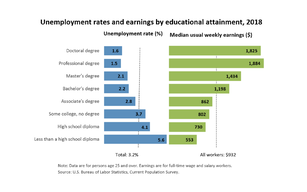

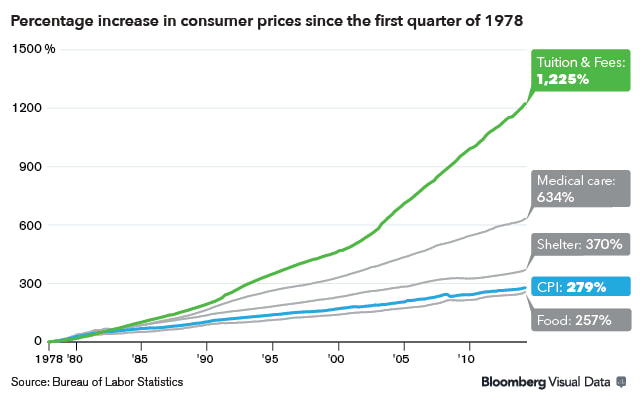

It depends on the degree and where you go to college. Let’s first talk in generalities and then move on to specifics. Four years at UNH will cost roughly $140,000. From the attached chart, the average college grad with a bachelor’s degree makes $1173/week or $60,996/year whereas the average high school grad makes $37,024; a difference of $23,972. Doing some quick math, $140,000/$23,972 = 5.84, your education is paid off. But keep in mind, the attached chart is for 25 year old grads and a 2017 article reports that by age 34, you will recoup your college tuition costs. In other words, you will have earned enough money to repay the cost of your degree and make up for your time out of the workforce by the age of 34.

However being an economist let’s look at it another way an include opportunity cost. In other words, if I wasn’t going to college, I would be working; so by going to college, I’m foregoing a year’s salary. Again generalities, as a high school grad, I would be making $28,000/year times 4 years equals $112,000 dollars that I am foregoing by going to college bringing my total cost of college to $252,000. We know divide this by $23,972 (the difference in earnings at age 25) and breakeven is now 10.5 years.

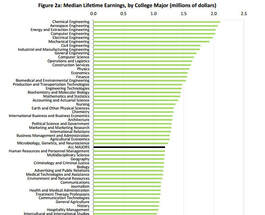

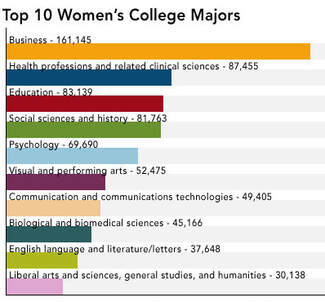

But what about some other degrees that are offered, such as Women Studies and Philosophy. To no surprise, liberal arts majors are at the lower end, generally in the mid-thirties. Besides Women Studies and philosophy, these include History, English Psychology, Social work and Elementary Education. Assuming a starting pay of $35,000, compared to a HS graduate of $28,000, I would have a breakeven of $252,000/$7000 of 36 years including opportunity cost, or without opportunity cost $140,000/$7000 of 20 years. Clearly to me, a Liberal Arts Major at UNH is not worth the cost. As an afterthought, what jobs does a women studies major qualify?

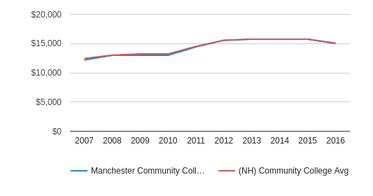

What then, is a person to do? There are a number of alternatives. The first is community colleges which are increasingly turning out students with quality degrees. In New Hampshire, community college tuition has increased only 2.4% in the past 8 years and a total price for 2 years at a community college is under $15,000, compared to $70,000 at UNH. For a good student, there is a clear path to a 4 year college after graduating from a community college such as Great Bay in Portsmouth or Northern Essex College located in Haverhill Ma.

Another alternative is an online course from a University such as SNHU, Southern New Hampshire University. At SNHU, an online course will cost $960, significantly lower than a course at UNH at over $4000. My personal preference is a face to face class, but given the cost, and the ineptness of some prof’s (especially those with tenure who concentrate on research as opposed to teaching), the benefit exceeds the cost.

RSS Feed

RSS Feed