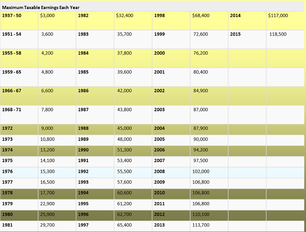

SS Taxable Income (click to enlarge)

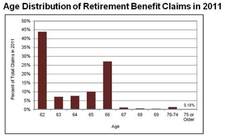

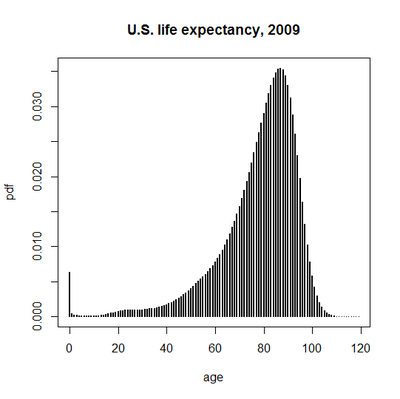

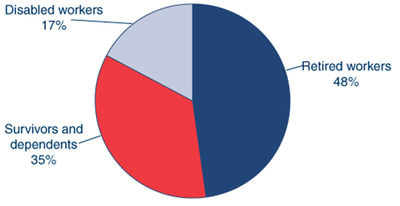

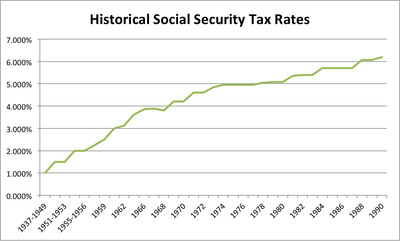

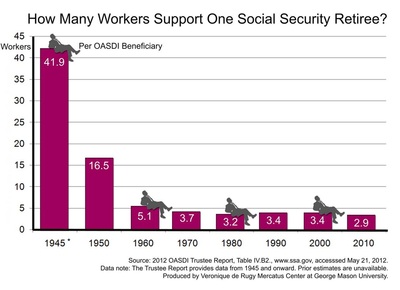

SS Taxable Income (click to enlarge) After it was signed into law it was implemented in 1937 and only the 1st $3000 of income was taxed and at the rate was 1%. In 2015, the maximum amount of taxable earnings is $118,500, and it will be taxed at 6.2%(this is matched by your employer). This is a function of the increased life span of Americans in addition to the larger amount of people on Social Security. When social security was passed, life expectancy was 65 which meant that half of the people contributing to social security would not live to collect it (life expectancy follow a bell shaped curve distribution). However, even though life expectancy has increased by 14 years in the US, the retirement age has only been increased to 66. Social Security is not only for retired workers, but survivors/dependents and people who are disabled.

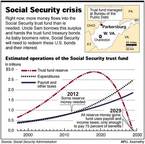

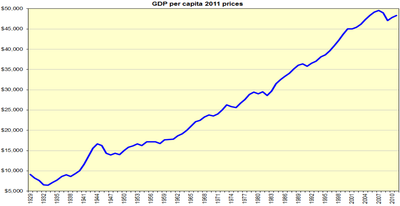

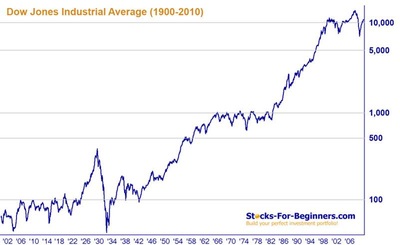

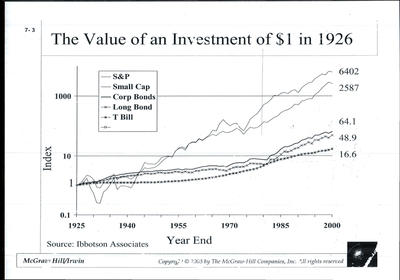

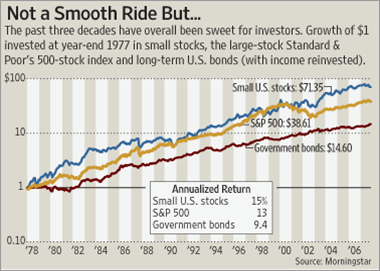

Ask any freshman business student what is the number one rule of financial portfolio management and he/she will tell you diversification, something the Social Security Administration is not doing. At this point, some of you are probably thinking, invest my SS money in the stock market, absolutely not! Relax and let's look at the figures and the numbers. Simply put, the stock market mirrors the American economy and over time, the American economy has gone nowhere but up, albeit with some bumps in the road but it remains upward trending (charts below).

RSS Feed

RSS Feed