In 1934, Roosevelt implemented the Agricultural Adjustment Act where growers signed acreage reduction contract which regulated the amount of land they could use to harvest certain crops. Additionally government took initiative to limit food supply by buying up livestock and crop surplus. Farmers were compensated for reducing their harvest of cash crops and given the freedom to diversify their crops with the newly found land surplus. This was the first emergence of farm subsidies .

Roosevelt called the aid “A temporary solution to deal with an emergency.” Presently, this ‘temporary solution’ has become interpreted as an entitlement to farmers. Each time the Farm Bill is called to the stand it is often called to stop subsidizing wheat but politicians fear that the loss of support from those in the agribusiness would be far too incriminating. As Milton Friedman put it “There is nothing more permanent than a temporary government aid program”

High food prices go against one of the most important goals of the USDA: To provide welfare to impoverished households. The extra money spent at the grocery store could be enough to change the eligibility of government aid for poor households by raising their real income. The USDA counteracts itself when it pays out money to raise prices as well as implementing aid programs such as food stamps to accommodate the consumer to them. Consumers in the US pay 30% more for necessities like eggs, milk and butter. Heightened raw food prices force consumers on a budget to substitute healthy foods with cheap sugary drinks, processed meats and candy.

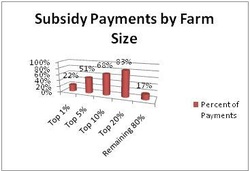

Farmers who receive the majority of government aid are often not in need of it. On average a successful farm is family owned for generations upon generations.

(Companies such as Dole and Chiquita receive thousands of dollars annually ) Consequently, the barrier to entry is high and anyone who wants to begin farming or expand their current farm is unable to gather enough capital to do so.

The cost creates a domino effect impacting producers, consumers, businesses and the economy as a whole. Potential trade opportunities are diminished because of the tariffs and high costs associated with purchase of raw material. Domestic and international companies are encouraged look elsewhere for cost efficient materials to use as inputs. The opportunity cost for businesses could be more employees and expansion but unfortunately production costs remain too high.

RSS Feed

RSS Feed