Bill O'Reilly

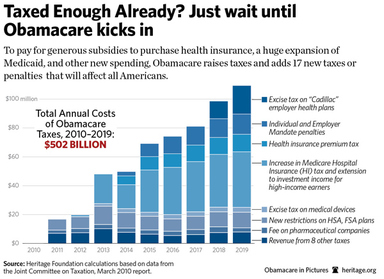

The affordable Care Act (Obamacare), continues to have unintended consequences and a burgeoning price tag; first the cost. In a recently released report from the Administration, the average subsidy for an Obamacare insured individual is $268. Doing some simple math yields the following: $268 subsidy/recipient multiplied by 7.5 million recipients times 10 yields a 10 year cost of $2.01 trillion a far cry from the $859 billion projected by the Administration. In addition, the cost of administering the program and the website has a yearly cost in the billions. Final numbers are not in, but as a result of Obamacare, healthcare costs appear to have risen more than 8% in 2014 and are expected to increase by 7% in 2015; 4 times the rate of inflation. In addition since 2008:

The average deductible has double from 1000 to 2000

The co-pay on doctor’s visits have doubled (including specialists)

Prescription drugs have increased by 50% (inflation by 15%)

Premiums have increased an average of 8%/year

What I find to be particularly egregious is the amount of lies (“If you like your insurance, you can keep it) and half-truths. What the Administration never told anyone is that if you are receiving a subsidy, you have to declare the subsidy and pay income taxes on it when you do your end of year tax return. Also, don’t forget the penalties for not having insurance and they are as follows: n 2015, the ACA penalty will be 2% of your household's annual income, or $325 per adult and $162.50 per child, whichever total amount is greater, to a maximum of $975. In our examples above, the single-person household would pay double the fee in 2015, $450, or a2% of their annual income. What does this mean? When Obamacare was passed, 48 million people were without insurance (many by choice, see June/July blog 2013), 7.5 million have taken advantage of the ACA which leaves 40 million people who have to pay the penalty.

And one last fact; A number of wealthy people are retiring before age 65 (the age of medicare eligibility), and they are showing no income (they are living by withdrawing money from various savings accounts). When you apply for insurance under the affordable care act, the application asks what your yearly income is and there are no questions concerning your wealth (assets minus debt). If you are withdrawing money from savings, this is not income. I personally know of two millionaires on Obamacare who are receiving more than $500 in subsidies/month and they are in line with the law.

RSS Feed

RSS Feed