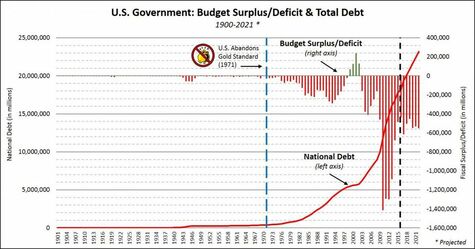

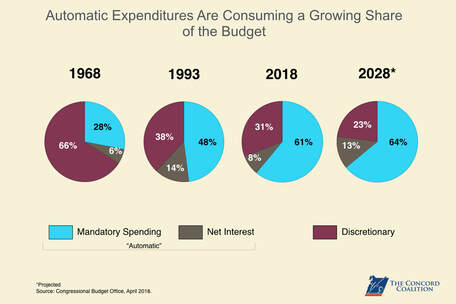

In 1836, Andrew Jackson paid off the national debt, and that was the last time, the US was debt free. In nominal figures, between 1836 and 2008, the US government amassed $10 trillion dollars, during the Obama administration, 8 years, he doubled the debt to $20 trillion. I was very critical of him then and I’m equally critical of Trump. In the two years Trump has been president, we are now over $22 trillion in debt. So much for his promise to balance the budget. What is particularly disconcerting is that we are in the best economy we’ve had in 20 years. The last time the economy was this good, the US had a surplus, in other words, tax revenues exceeded spending and this was during the last 3 years of the Clinton Administration and the 1st year of the Bush administration. The reason for the surplus was the low unemployment rate and as a result, the large amount of income tax received by the government. However, because the Trump tax cuts (which I love) were not accompanied by spending cuts (which I hate), the yearly deficit, and hence the debt, continued to skyrocket. A big problem with the debt is Congress. Since there are no term limits for Congressmen/women, they will generally vote to get re-elected and not what’s good for the economy. What gets members of Congress re-elected is bringing money into their district and pockets (either by tax cuts and/or welfare) and the budget deficit gets a back seat. It is time to stop kicking the can down the road.  In fiscal 2018 the interest that is paid on the debt increased by $62 billion to $371 billion/year. That represents an increase of 20%, and currently, 8 cents, up from 6.8 cents, of every budget dollar goes towards paying off that interest, and it continues to get worse. According to the Washington Post, interest costs are the fastest growing part of the federal budget and is beginning to grow exponentially. The deficit for fiscal 2018 was an estimated $782 billion, up from $666 billion in 2017, according to the CBO. Kevin Hassett, chairman of the White House's Council of Economic Advisers, this week said the White House will release plans on how to attack it according to Bloomberg (I’m not holding my breath). According to the Wall St, journal, Fiscal 2018 spending exploded by nearly 130 percent, but federal tax receipts rose just 0.4 percent. That's partly because of a 31 percent decline in corporate tax payments and other features included in last year's tax cut bill. There is something drastically wrong when a company like Amazon makes over $11 billion and profits, and not only doesn’t have to pay any taxes, but gets a $129 million rebate.

0 Comments

Leave a Reply. |

AuthorJohn Tommasi is a retired Senior Lecturer of Economics & Finance from Bentley University and the University of New Hampshire. Archives

February 2023

Categories |