The attached chart is from the US Tax Foundation:

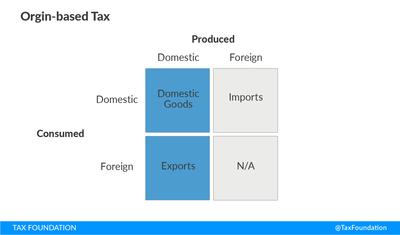

An origin based-tax (like what we have in place now) is one that taxes goods based on where they are produced, regardless of where they are consumed. As such, an origin-based tax applies to both goods produced and consumed domestically (purely domestic goods) and to goods produced in the U.S. and consumed in foreign countries (exports). In the two-by-two matrix (below), an origin-based tax is applied to the top and bottom boxes on the left.

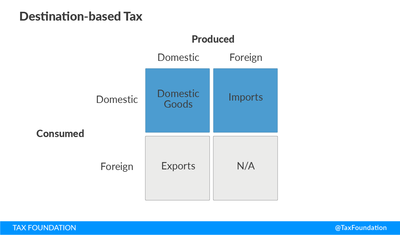

As a result, a destination-based tax is neutral with respect to domestic consumption but could be positive if consumption of goods produced domestically increase and be profitable for businesses if exports increase.

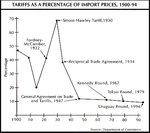

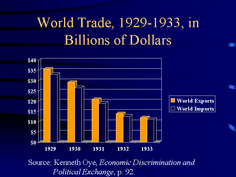

What could go wrong? What lawmakers aren’t taking into effect is that we import goods for a reason, i.e., cheaper prices. As a result of higher domestic prices, consumption/demand will decrease which will have a multiplier effect. In addition, it never ceases to amaze me how Congress fails to learn from history. It is quite in the realm of possibility that other countries will reciprocate with a BAT of their own or just a simple tariff. For the most part, I like Trumps pro-business agenda of lower taxes and less regulation, however, I think the BAT tax will do more harm than good.

RSS Feed

RSS Feed