Overall, I believe the economy will benefit greatly from Trump’s policies and that his stance on trade will be softened.

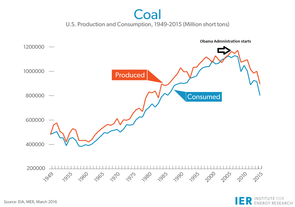

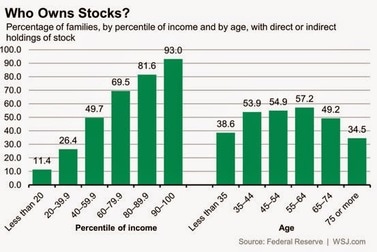

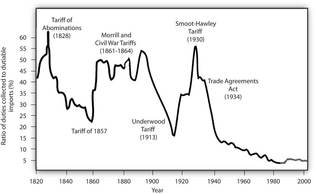

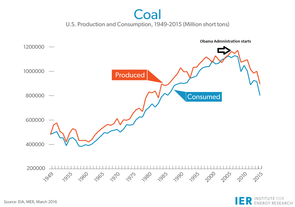

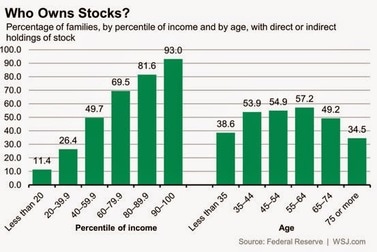

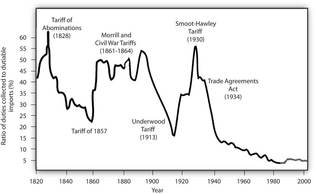

Trump is now the 45th president of the United States. What can we expect? He has made no bones about it he wants to stimulate economic growth. One of his 1st acts, via an executive order, was to put a moratorium on any new agency regulations, which was consistent with his campaign promises of less regulation. Before I go any further, I am a proponent of legislation. That is one of the functions of the government; specifically, when you have market failure (such as excessive pollution, it is the function of government to correct that failure, and it is usually done by regulation. What I am an opponent to, is excessive regulation and it appears that Trump is on the road to filling that promise. For a business, excessive regulation translates into costs (think EPA and the coal industry) and with the uncertainty of more regulation gone, you will see an increase in business investment which will probably spur GDP to surpass 3% (which was never see in the Obama administration).  Next comes taxes. There is some confusion over corporate taxes. Some websites will say that the corporate tax is 35%, and others 39%. Which is it? Actually both are correct. The Federal corporate tax (the highest in the world) is 35%. However, in addition to that, corporations must also pay a state corporate tax. This differs by state (some states have no corporate tax), but the US average is 4%, hence the 39% rate. Trump wants to reduce the corporate rate to 15%. A 15% rate, will come close to doubling corporate profits. Higher profits mean higher stock prices, and 53% of all Americans have some form of stock ownership (IRA’s 401K’s etc), which in turn leads to appositive wealth effect, higher consumption (70% of GDP), and a better economy Chances are, Congress will probably not go for a rate this low, but 20-25% is on the table which will have a similar effect.  Next is his proposed stimulus on infrastructure. Any stimulus that targets investment of economic capital is without a doubt, good, in the short run, for the economy. My long term concern is, if this stimulus is funded by deficit financing, it will add to an already crushing debt (once again compliments of the Obama Administration). To put the debt in perspective, the last time the US was without debt was in 1836. Between 1836 and 2008, the US amassed $10 trillion in debt, which Obama doubled in 8 years as a result, primarily, of a stimulus that was more than 1/3 appropriations (give away). At some point, we need to balance the budget.  Lastly, we’ll look at trade and to quote Shakespeare, “Ah, there’s the rub”. Ben Franklin said it best, “No one was ever ruined by trade.” Trade is good, particularly when you take into account opportunity cost and comparative advantage. However, the caveats are free trade and a level playing field. If we do get into a trade war with some of the countries President Trump has called unfair to the U.S., and if tariffs are added, higher prices on goods are inevitable. For example, the next car a driver buys could cost more than they think, given the added costs that get passed on to consumers. "If automakers are forced to pay tariffs to bring those cars into the U.S., that could make that market much less competitive for them. They could stop making those cars entirely (CNBC)." Amongst the higher tariff ever was the Smooth Hawley tariff of 1930 and it had disastrous effects on world trade. It was quickly overturned as nations learned that free trade is good for all concerned. Overall, I believe the economy will benefit greatly from Trump’s policies and that his stance on trade will be softened.

0 Comments

Leave a Reply. |

AuthorJohn Tommasi is a retired Senior Lecturer of Economics & Finance from Bentley University and the University of New Hampshire. Archives

February 2023

Categories |